General Dynamics Reports Second-Quarter 2018 Results

FALLS CHURCH, Va. –

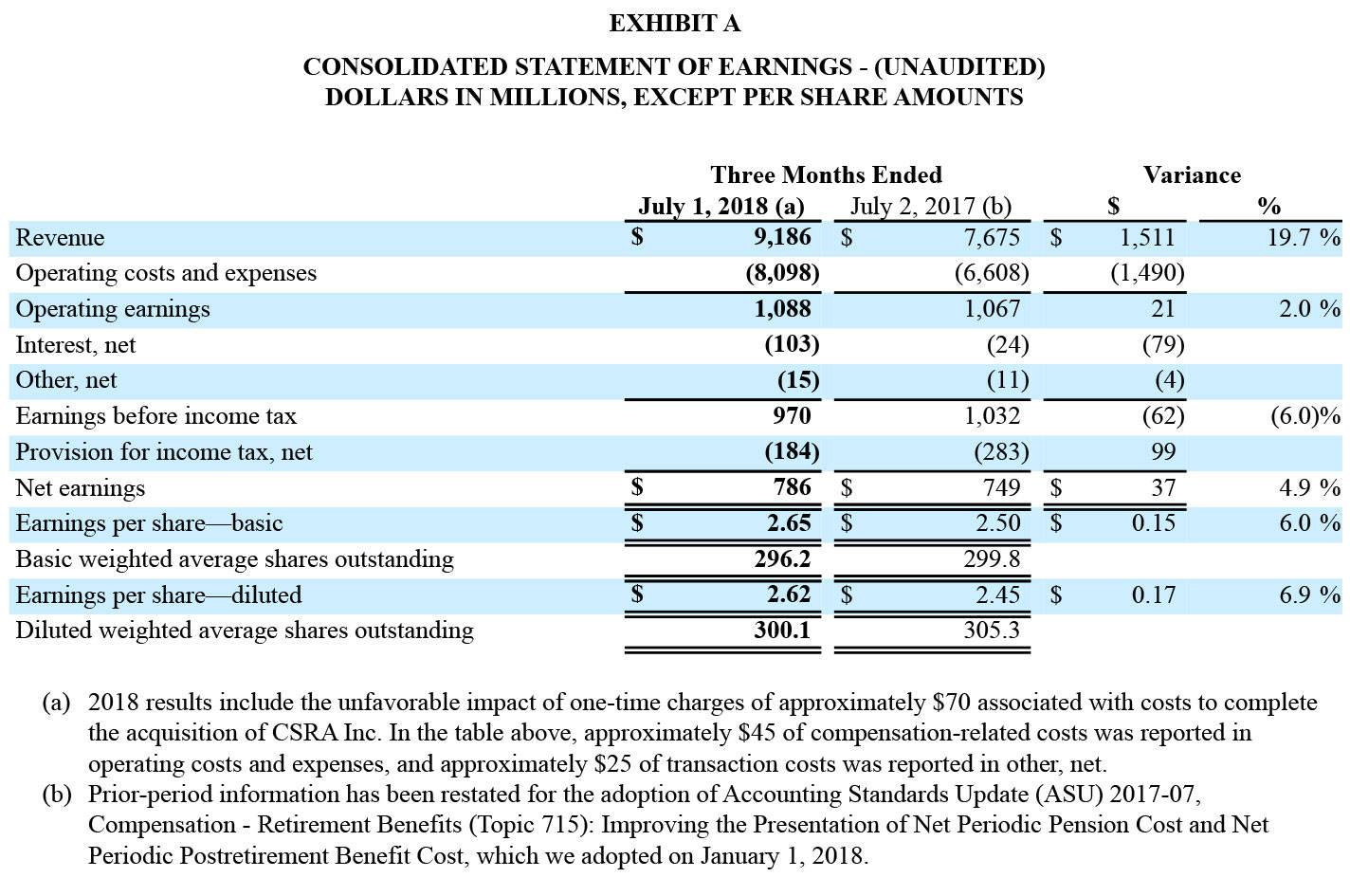

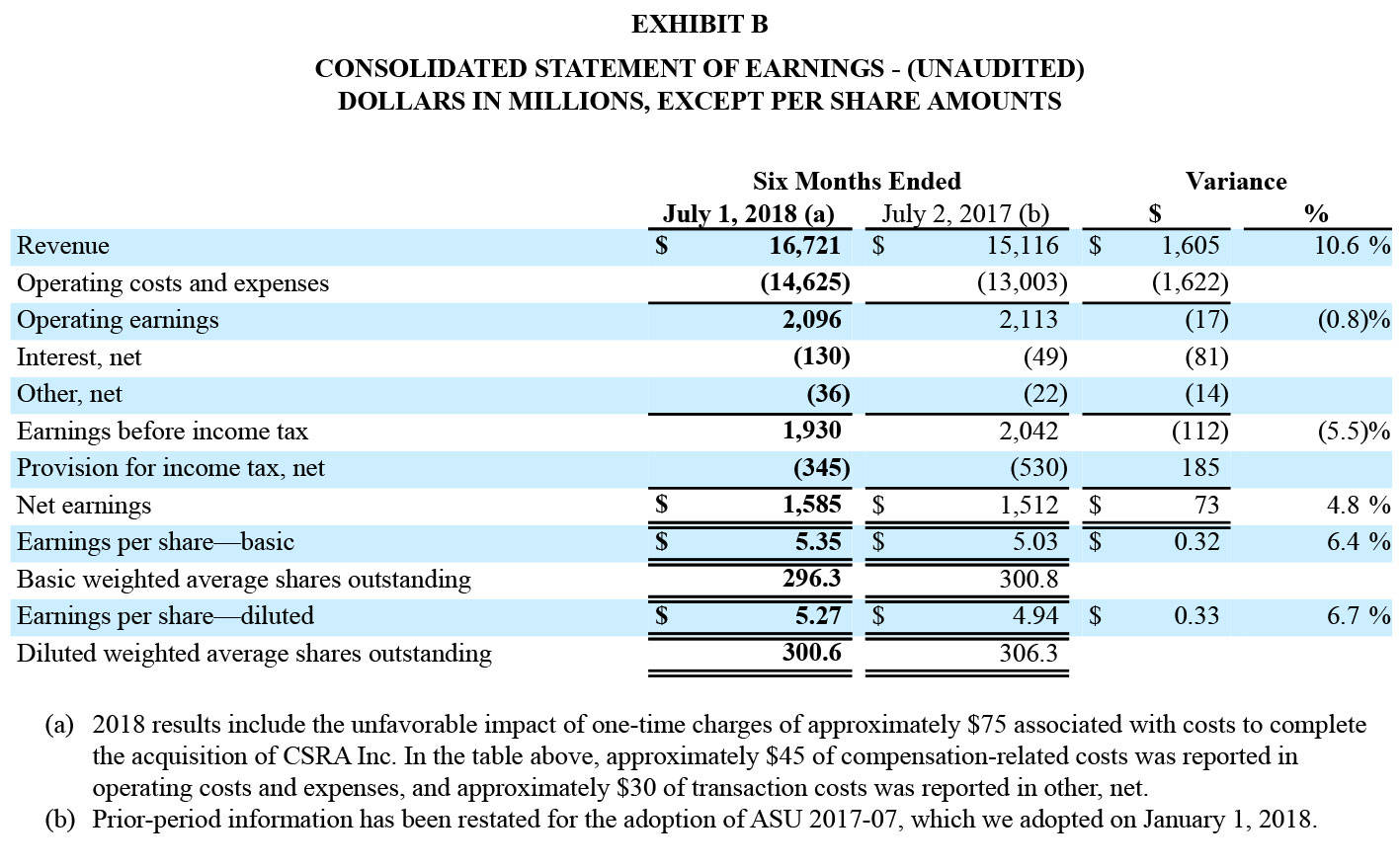

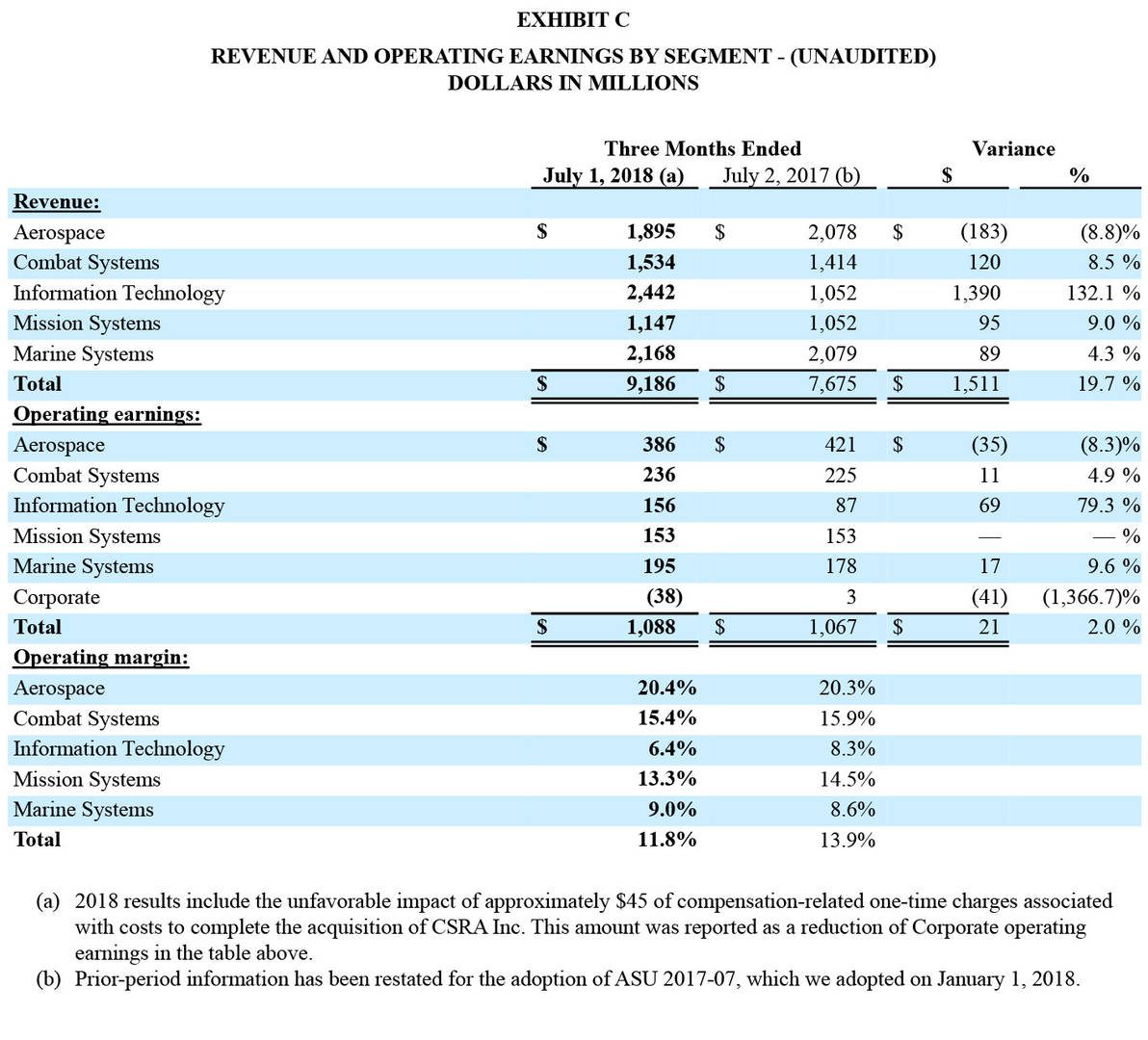

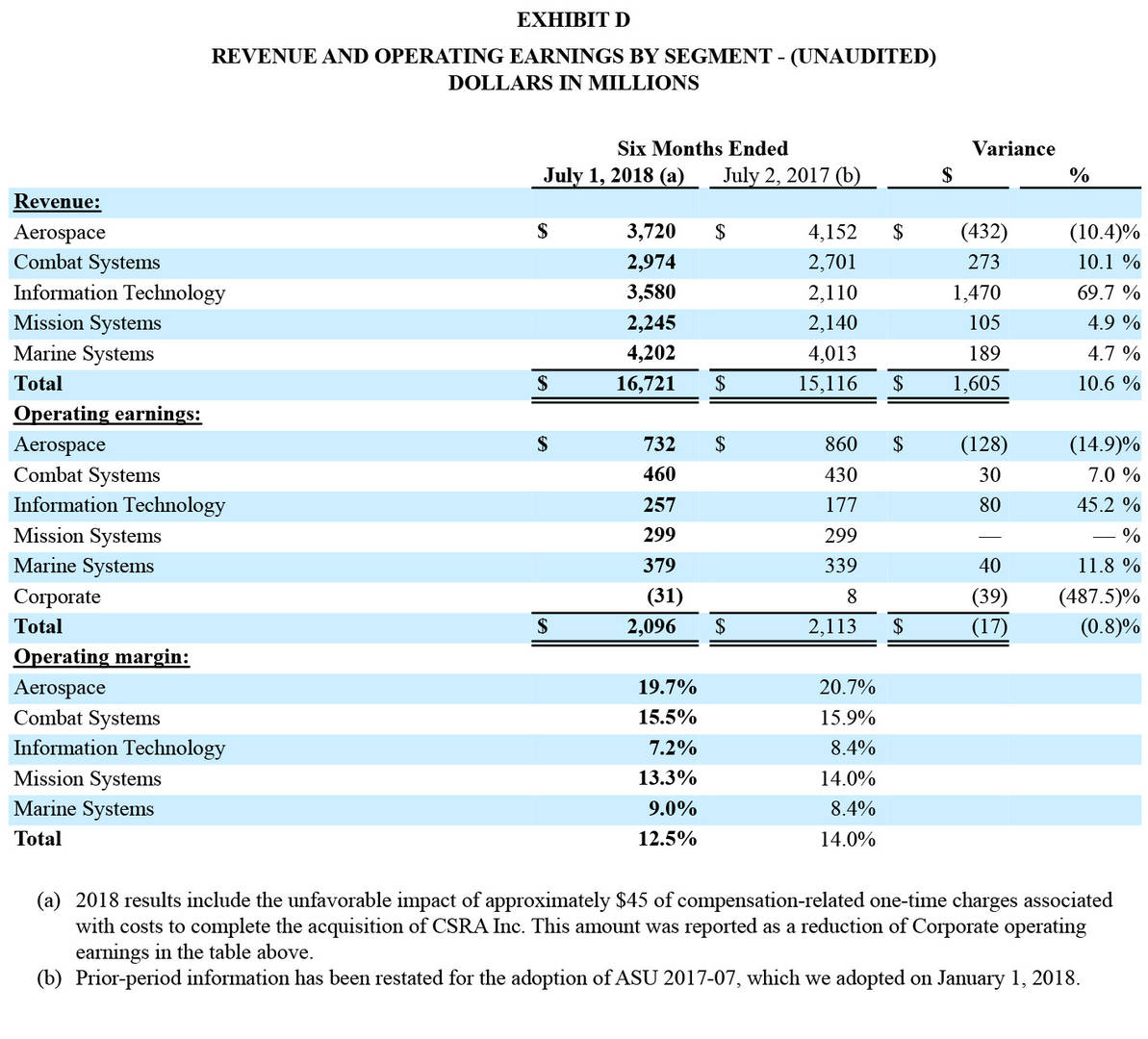

General Dynamics (NYSE: GD) today reported second-quarter 2018 net earnings of $786 million, a 4.9 percent increase over second-quarter 2017. Revenue increased by 19.7 percent to $9.2 billion due to strong defense volumes and the acquisition of CSRA. On an organic basis, the defense businesses generated a 7.1 percent revenue increase.Diluted earnings per share (EPS) was $2.62 compared to $2.45 in the year-ago quarter, a 6.9 percent increase. In the quarter, the company incurred one-time charges totaling $0.20 per share related to the acquisition of CSRA. Absent the charge, EPS would have been 15.1 percent higher than second-quarter 2017.

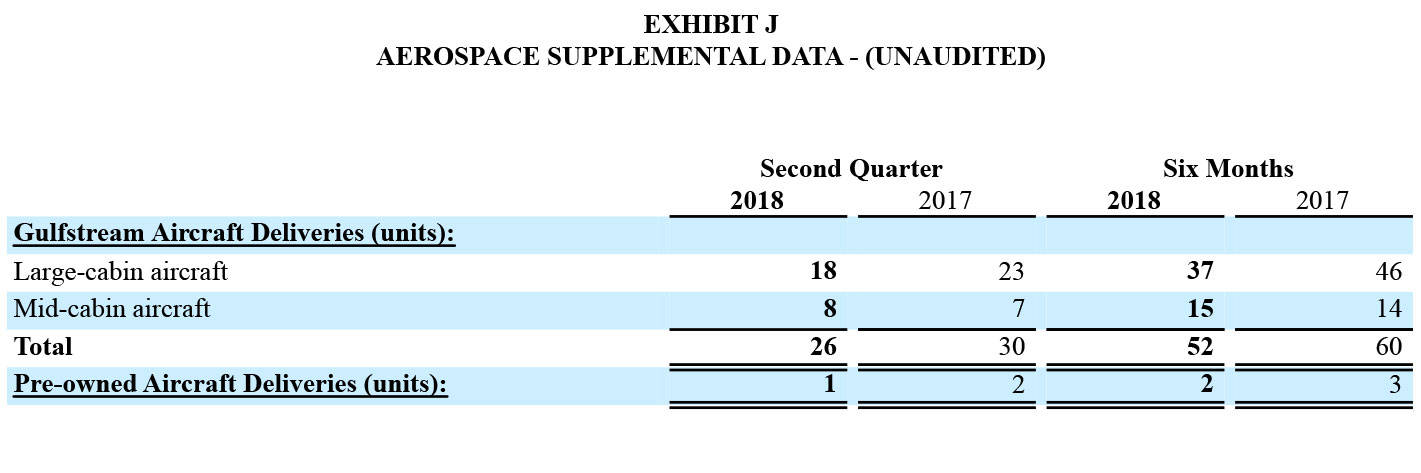

“General Dynamics delivered solid operating results and accomplished a number of key strategic objectives across the portfolio,” said Phebe N. Novakovic, chairman and chief executive officer. “We closed on the CSRA acquisition, building on our core GDIT business to create a leading government IT services provider, and integration of the business is well underway. Our Combat and Marine segments continue to have reliable growth with strong operating performance. And the FAA certified the G500 and we look forward to delivering this newest Gulfstream aircraft to our customers in fourth-quarter 2018.”

Margin

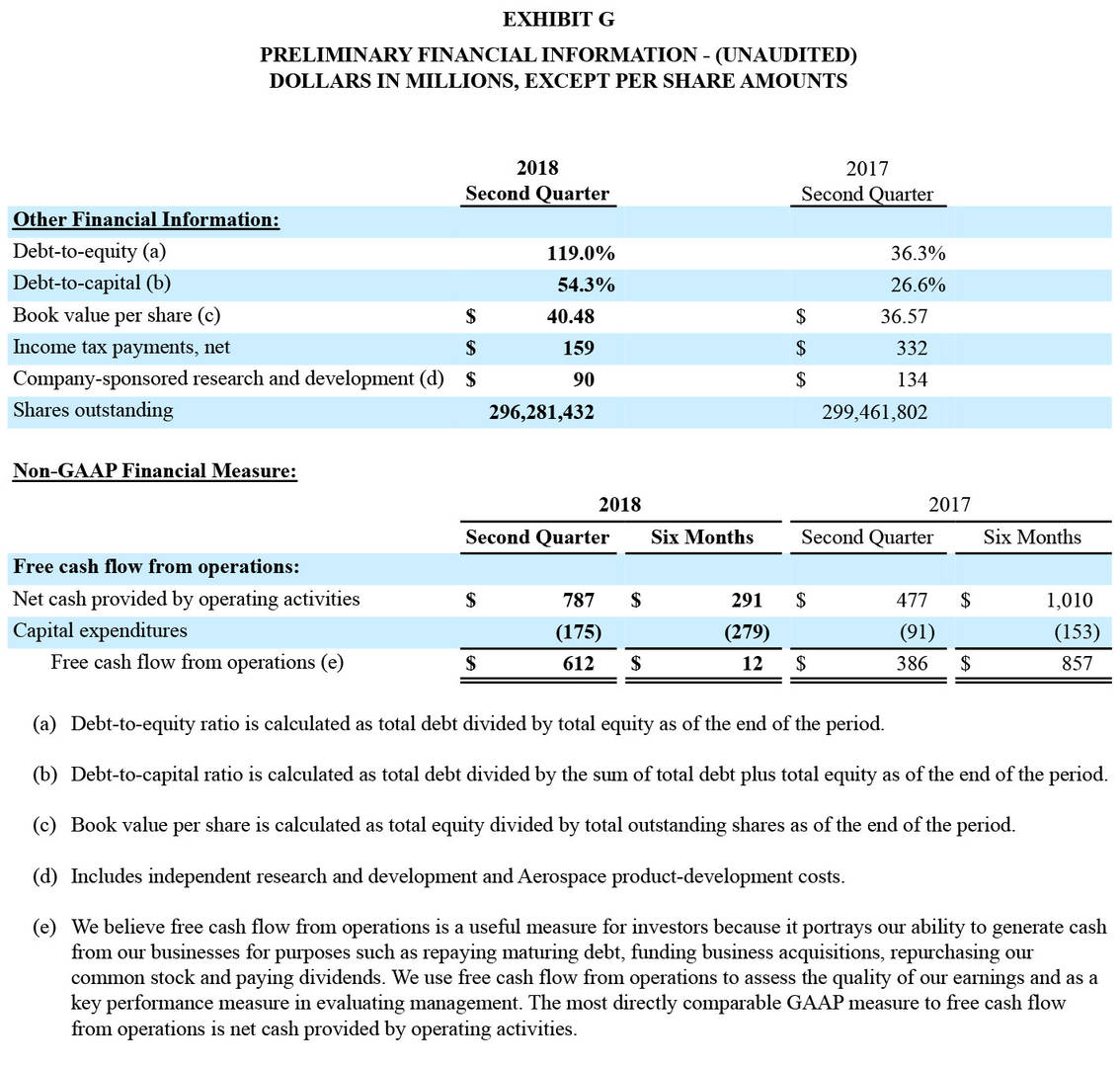

Company-wide operating margin for the second quarter of 2018 was 11.8 percent, including one-time transaction costs and incremental intangible asset amortization associated with the CSRA acquisition. This is compared to 13.9 percent in second-quarter 2017.

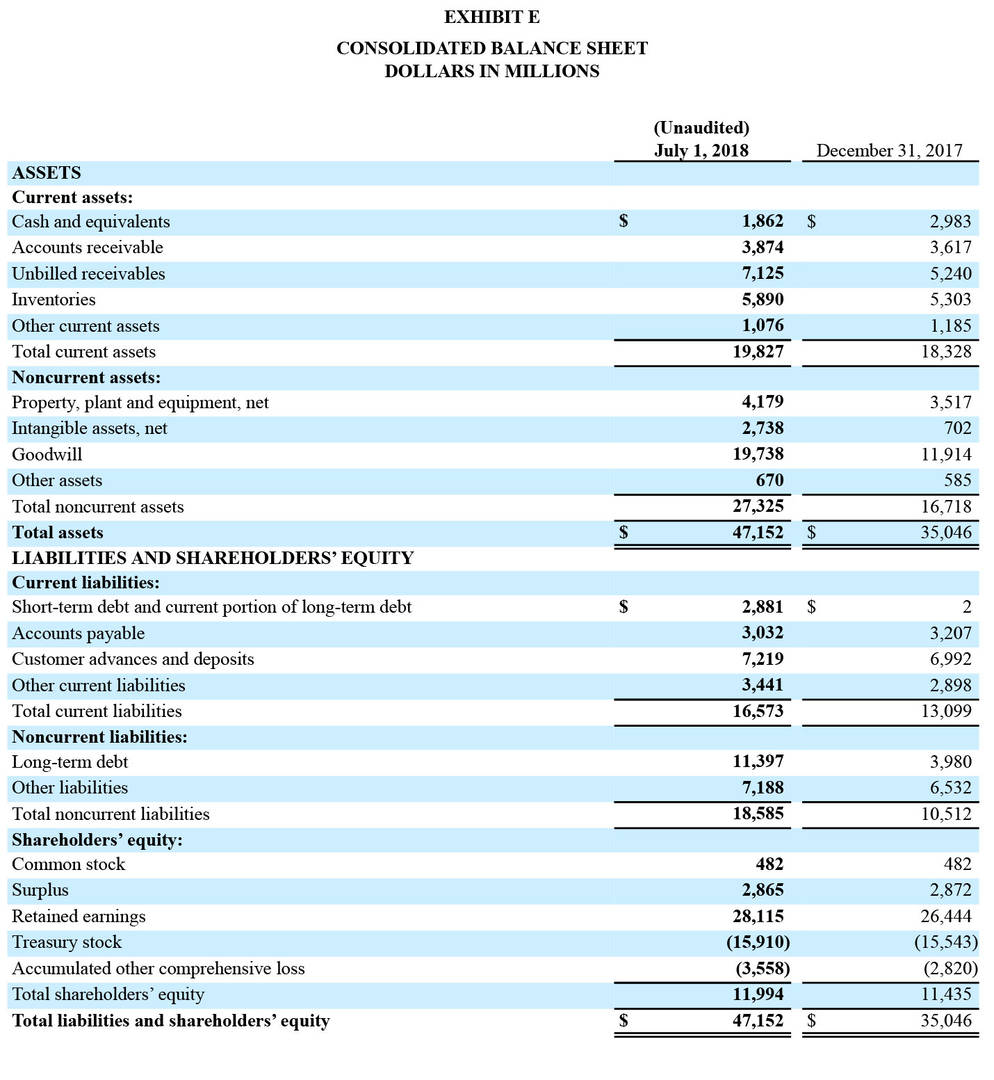

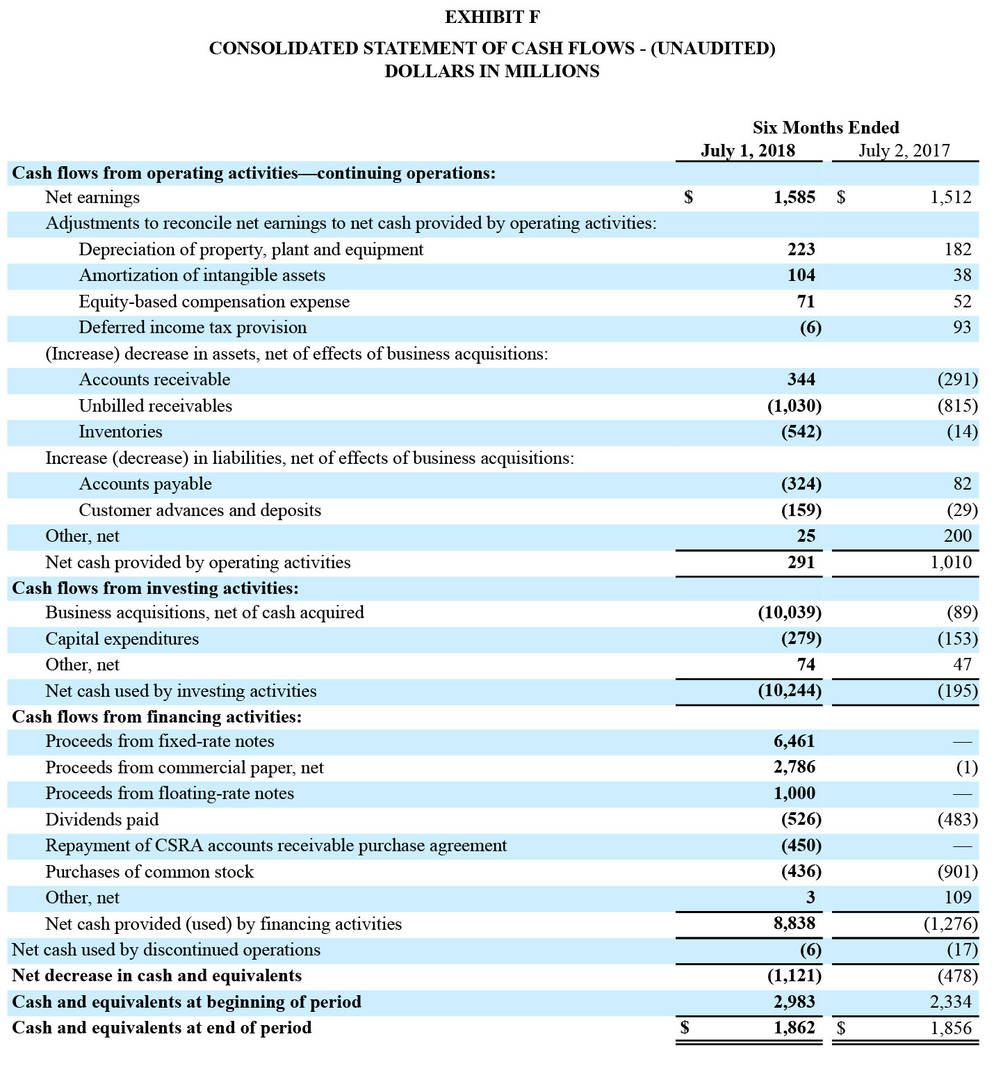

Cash

Net cash provided by operating activities in the quarter totaled $787 million, compared to $477 million from the year-ago quarter. Free cash flow from operations, defined as net cash provided by operating activities less capital expenditures, was $612 million.

Capital Deployment

The company repurchased 0.9 million of its outstanding shares for $179 million in the second quarter. Year-to-date, the company has repurchased 2.1 million outstanding shares for $436 million.

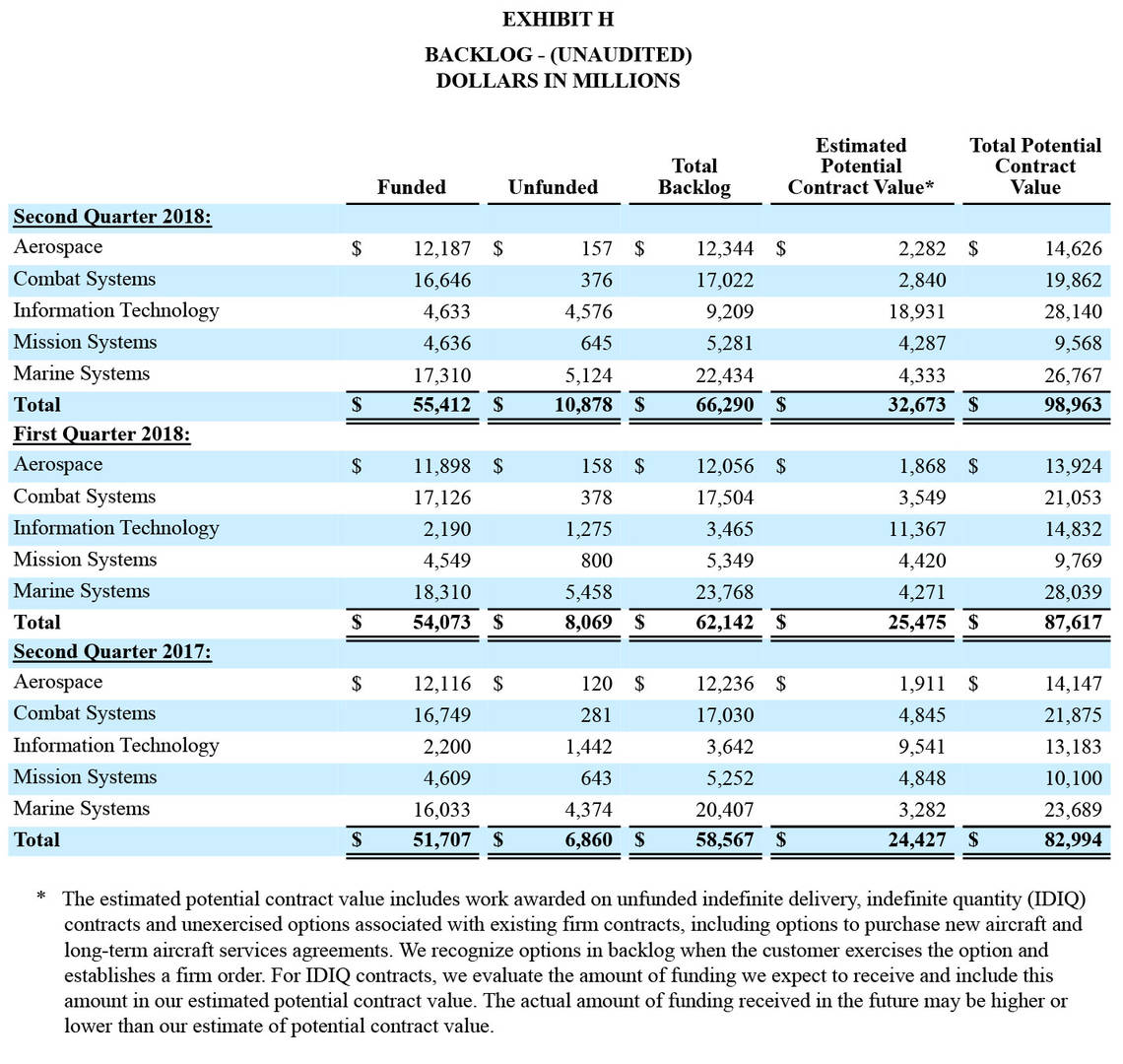

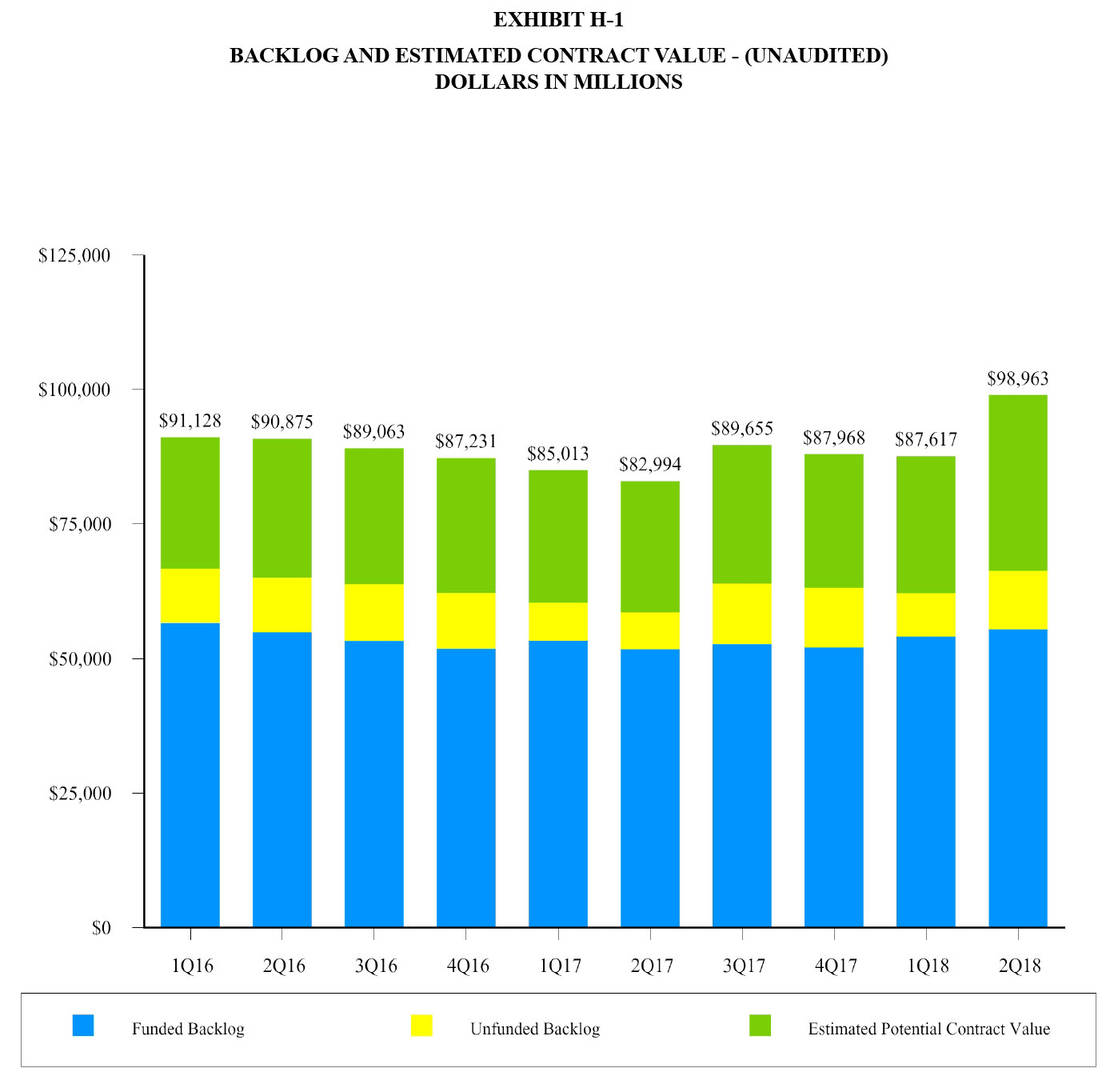

Backlog

General Dynamics’ total backlog at the end of second-quarter 2018 was $66.3 billion. The estimated potential contract value, representing management’s estimate of value in unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised options, was $32.7 billion. Total potential contract value, the sum of all backlog components, was $99 billion at the end of the quarter.Gulfstream unit orders were 21 percent higher than the year-ago quarter, with large-cabin orders accounting for approximately 75 percent of the demand.

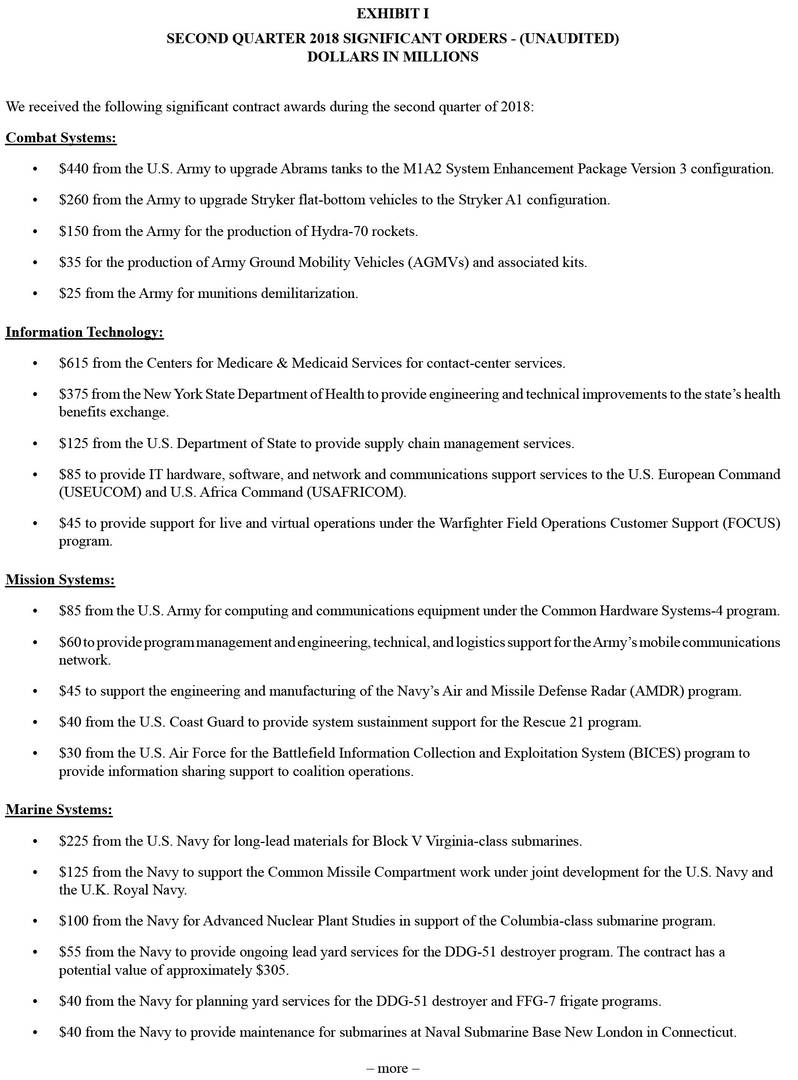

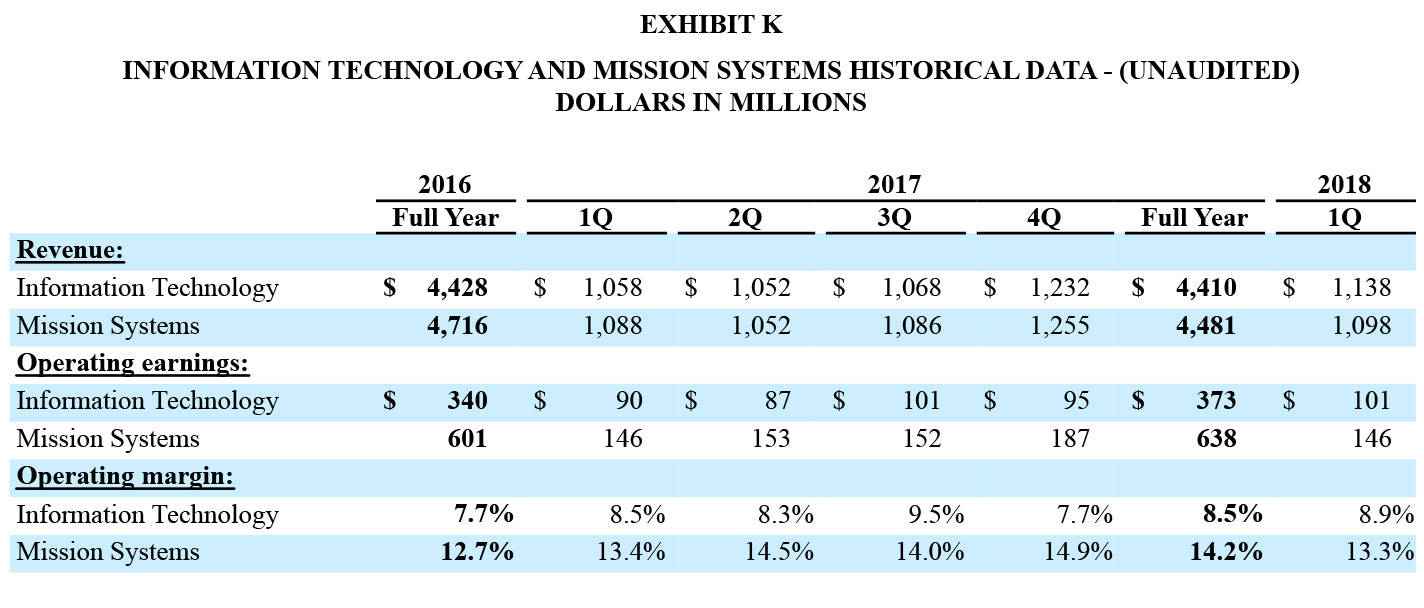

Total backlog for the defense businesses was up 7.7 percent from the end of first-quarter 2018, due to the CSRA acquisition and strong order activity across the segments. On an organic basis, Information Technology achieved a book-to-bill ratio greater than one-to-one, and the book-to-bill ratio in Mission Systems was one-to-one. Significant awards in the quarter include $615 million from the Centers for Medicare & Medicaid Services for contact-center services, $440 million from the U.S. Army to upgrade Abrams main battle tanks, $260 million from the Army to upgrade Stryker vehicles, $225 million from the U.S. Navy for Block V Virginia-class submarines, $150 million from the Army for the production of Hydra-70 rockets and $125 million from the Navy for Common Missile Compartment work.

About General Dynamics

Headquartered in Falls Church, Virginia, General Dynamics is a global aerospace and defense company that offers a broad portfolio of products and services in business aviation; combat vehicles, weapons systems and munitions; IT services; C4ISR solutions; and shipbuilding and ship repair. The company’s 2017 revenue was $31 billion. More information is available at www.generaldynamics.com.Certain statements made in this press release, including any statements as to future results of operations and financial projections, may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management’s expectations, estimates, projections and assumptions. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors. Additional information regarding these factors is contained in the company’s filings with the Securities and Exchange Commission, including, without limitation, its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. All forward-looking statements speak only as of the date they were made. The company does not undertake any obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this press release.

WEBCAST INFORMATION: General Dynamics will webcast its second-quarter 2018 financial results conference call at 9 a.m. EDT on Wednesday, July 25, 2018. The webcast will be a listen-only audio event, available at www.generaldynamics.com. An on-demand replay of the webcast will be available by 12 p.m. on July 25 and will continue for 12 months. To hear a recording of the conference call by telephone, please call 877-344-7529 (international: 412-317-0088); passcode 10121441. The phone replay will be available from July 25 through August 1, 2018.

Exhibits