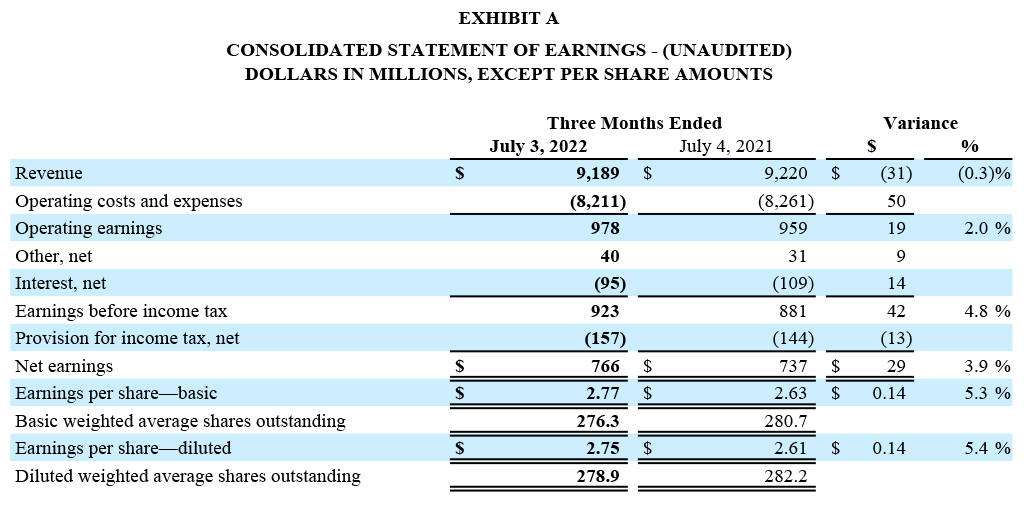

- Net earnings of $766 million on revenue of $9.2 billion

- Operating margin 10.6%, up 20 bps year over year, 90 bps sequentially

- Diluted EPS of $2.75, up 5.4% year over year

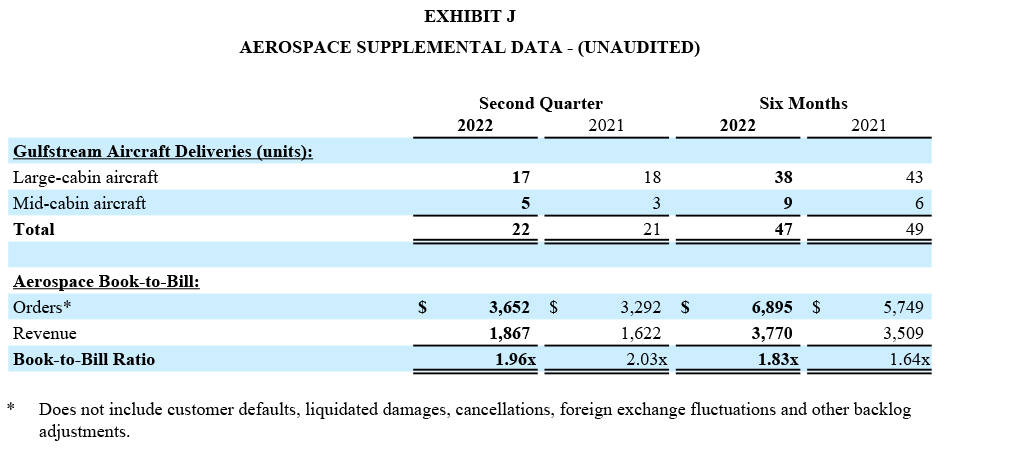

- Continued strong Gulfstream demand

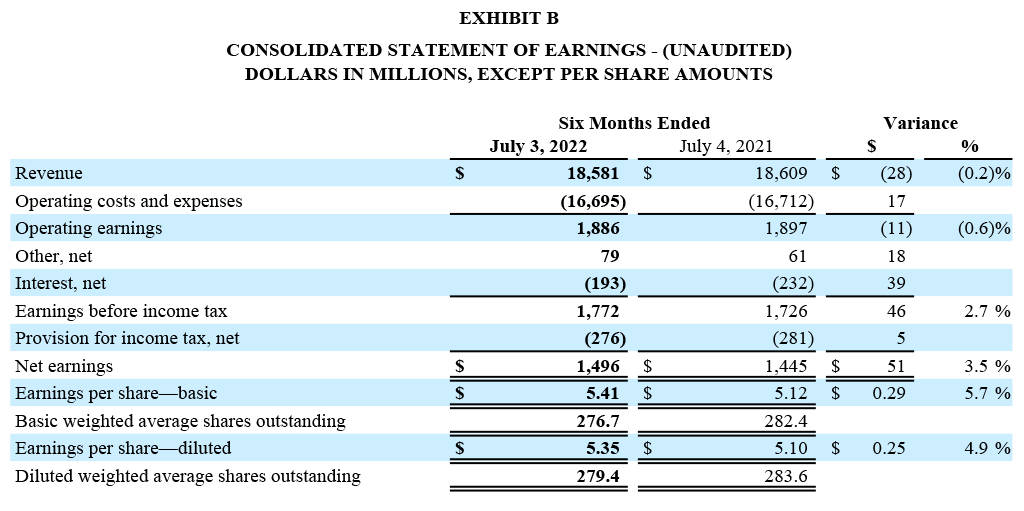

RESTON, Va. – General Dynamics (NYSE: GD) today reported second-quarter 2022 net earnings of $766 million on revenue of $9.2 billion. Diluted earnings per share (EPS) were $2.75, a 5.4% increase from the year-ago quarter.

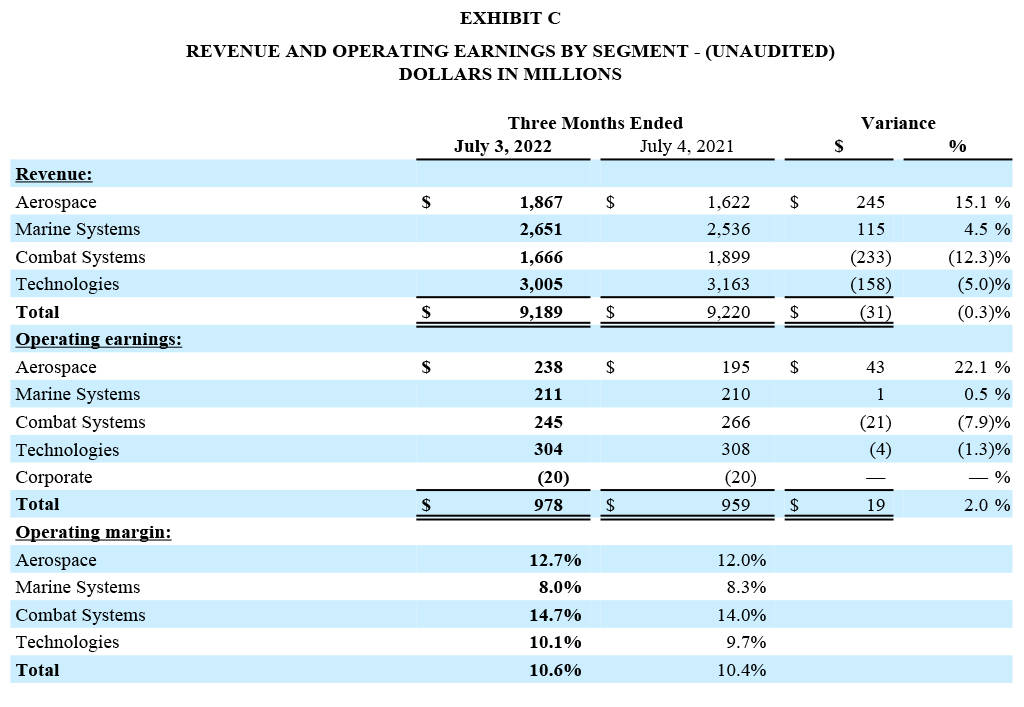

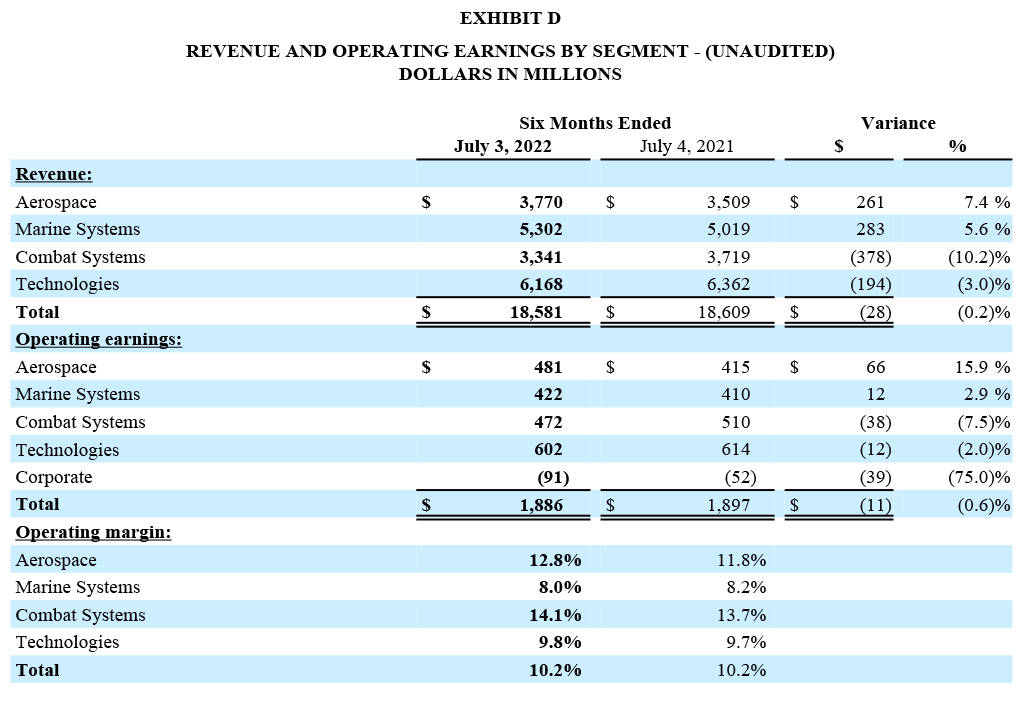

“Demand in the quarter was very strong in Aerospace, with margins showing steady improvement year over year.” said Phebe N. Novakovic, chairman and chief executive officer. “Our defense segments demonstrated solid operating performance and had several important wins.”

Cash

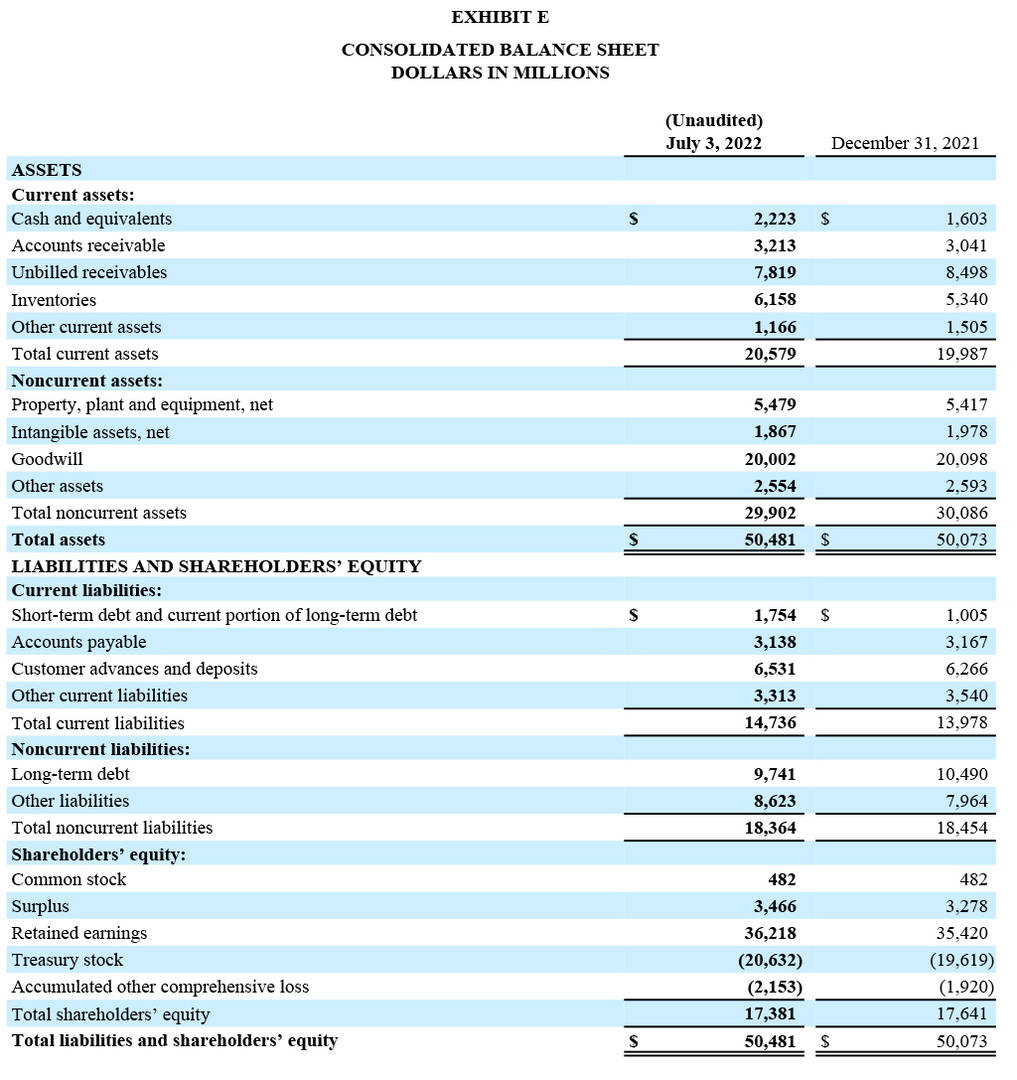

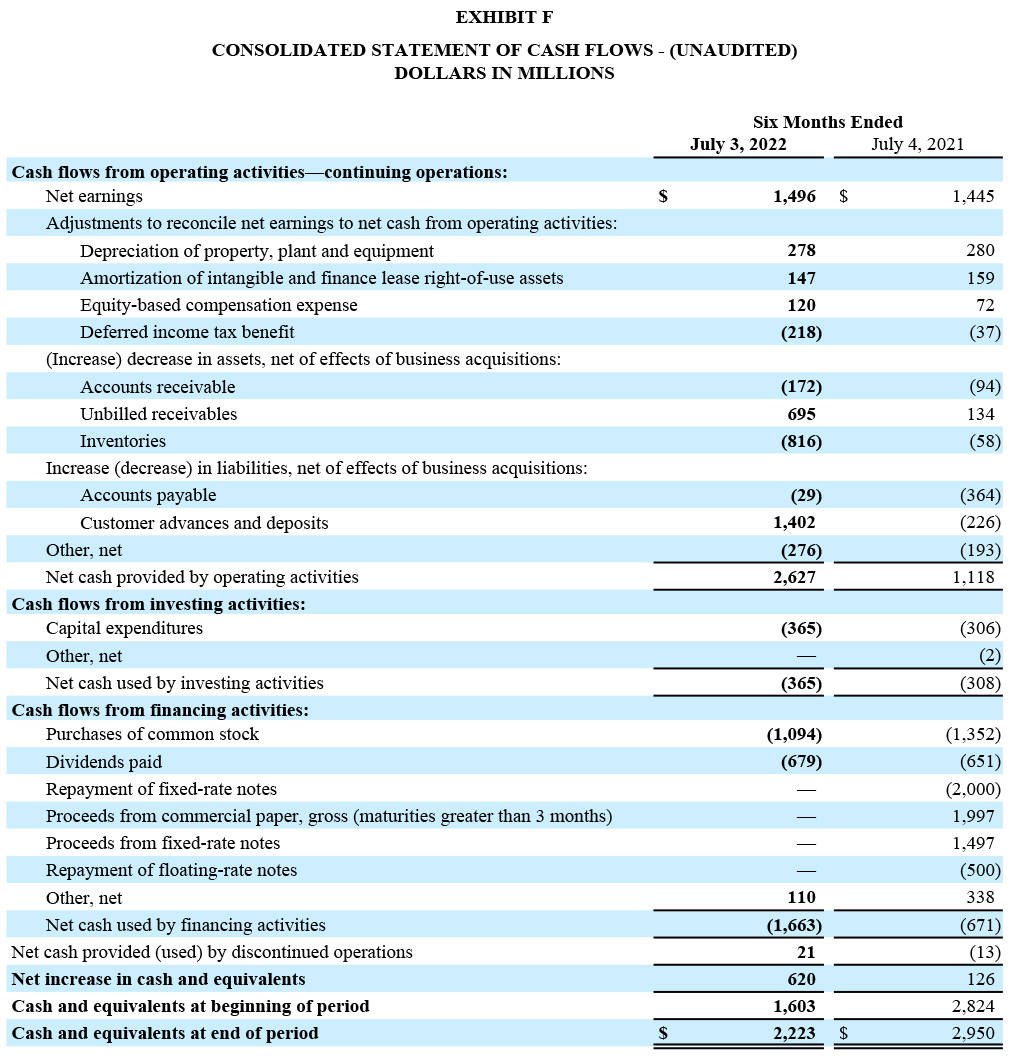

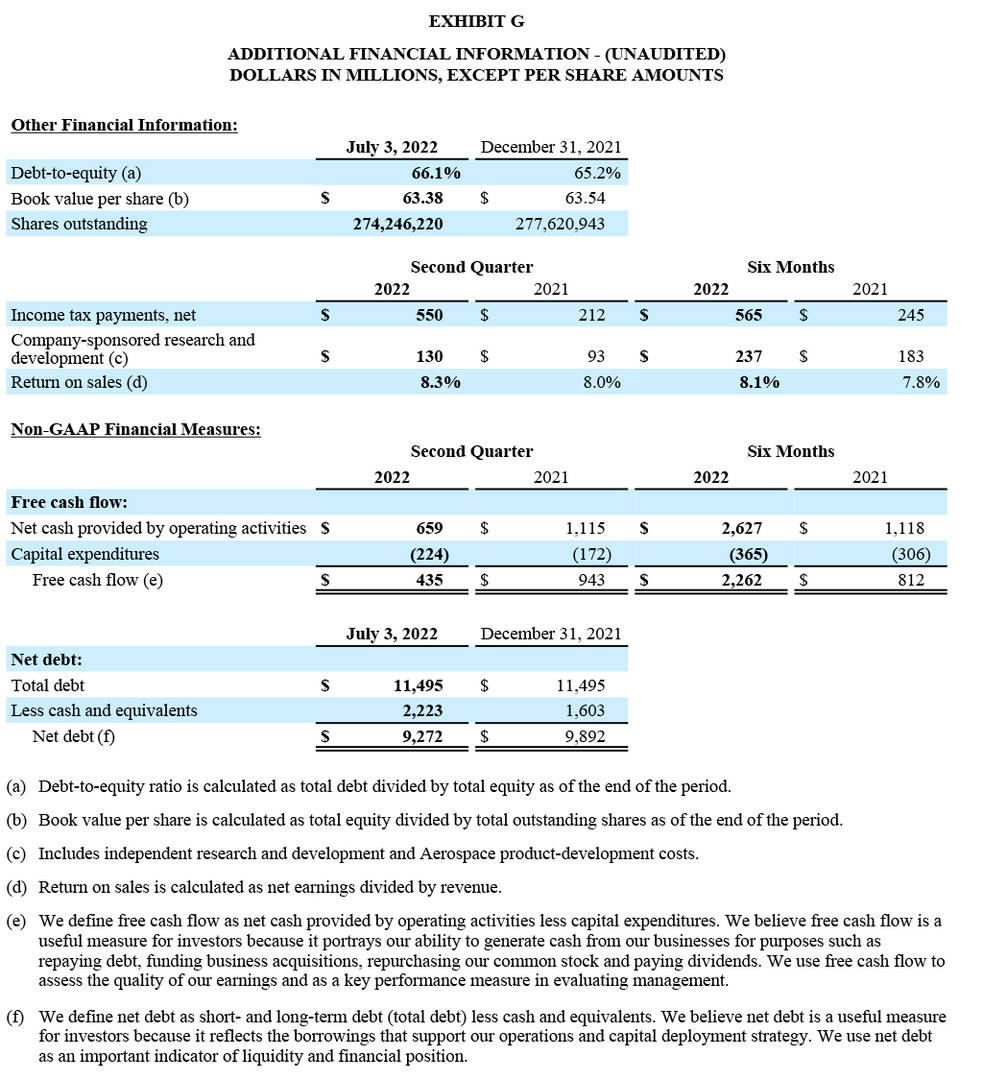

Net cash provided by operating activities in the quarter totaled $659 million. During the quarter, the company invested $224 million in capital expenditures, paid $349 million in dividends, and used $800 million to repurchase shares, ending the quarter with $2.2 billion in cash and equivalents on hand. For the first half of the year, net cash provided by operating activities totaled $2.6 billion, or 176% of net earnings.

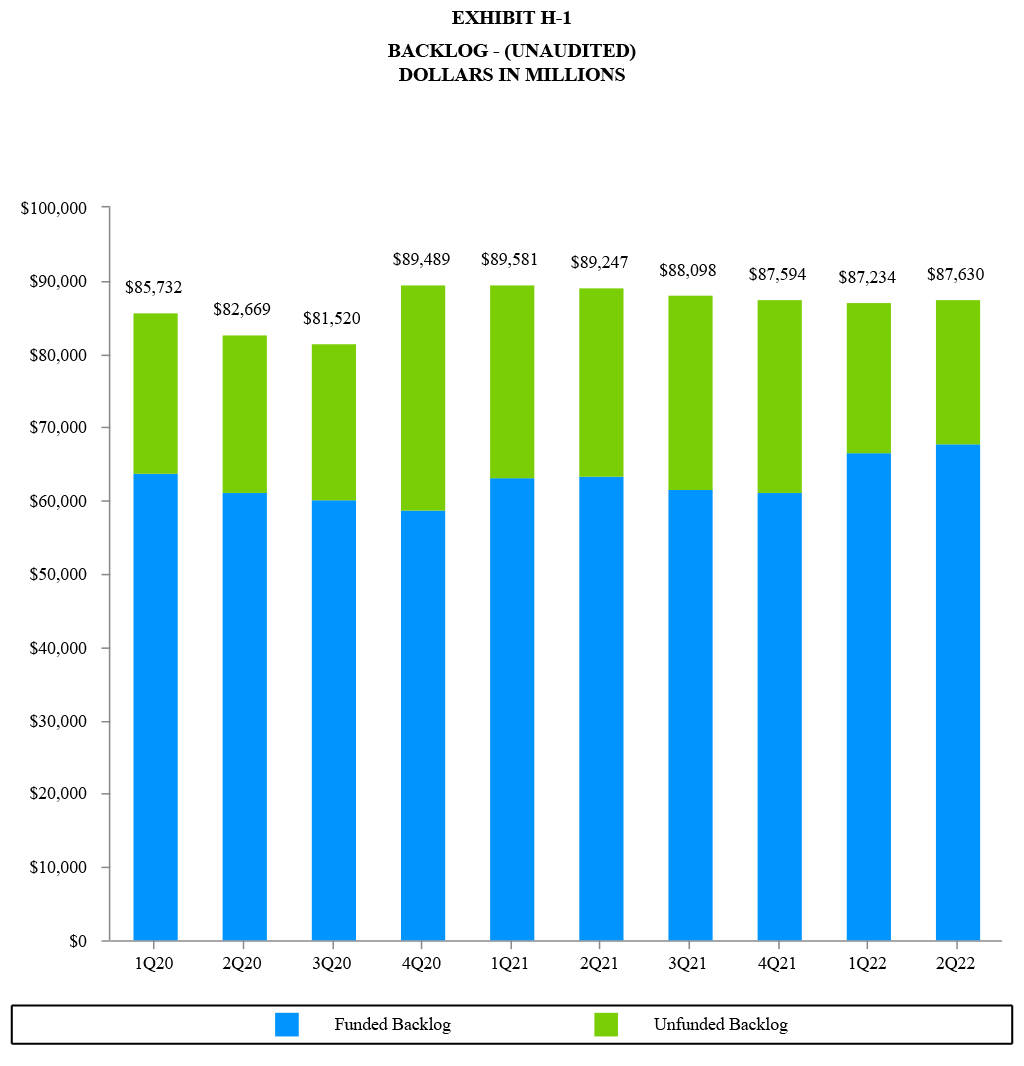

Backlog

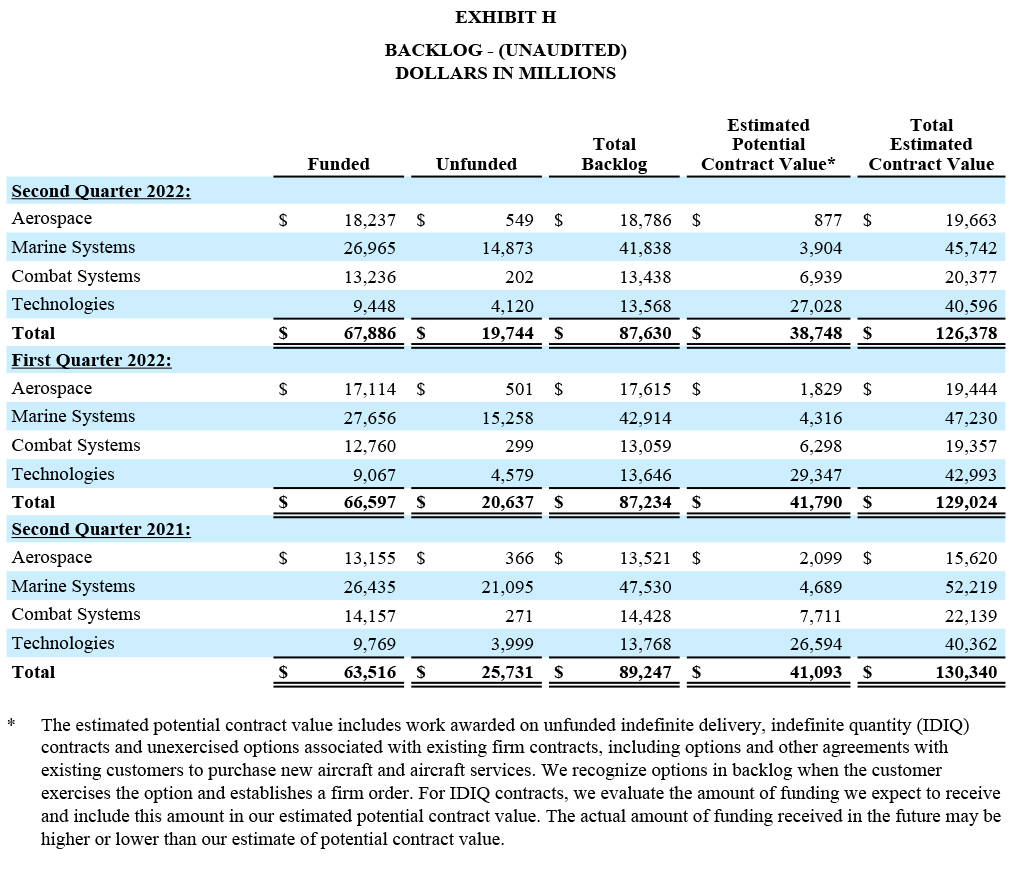

Orders remained strong across the company with a consolidated book-to-bill ratio, defined as orders divided by revenue, of 1.1-to-1 for the quarter, with particular strength in the Aerospace segment driven by strong order activity for Gulfstream aircraft. In addition to company-wide backlog of $87.6 billion, estimated potential contract value, representing management’s estimate of additional value in unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised options, was $38.7 billion. Total estimated contract value, the sum of all backlog components, was $126.4 billion at the end of the quarter.

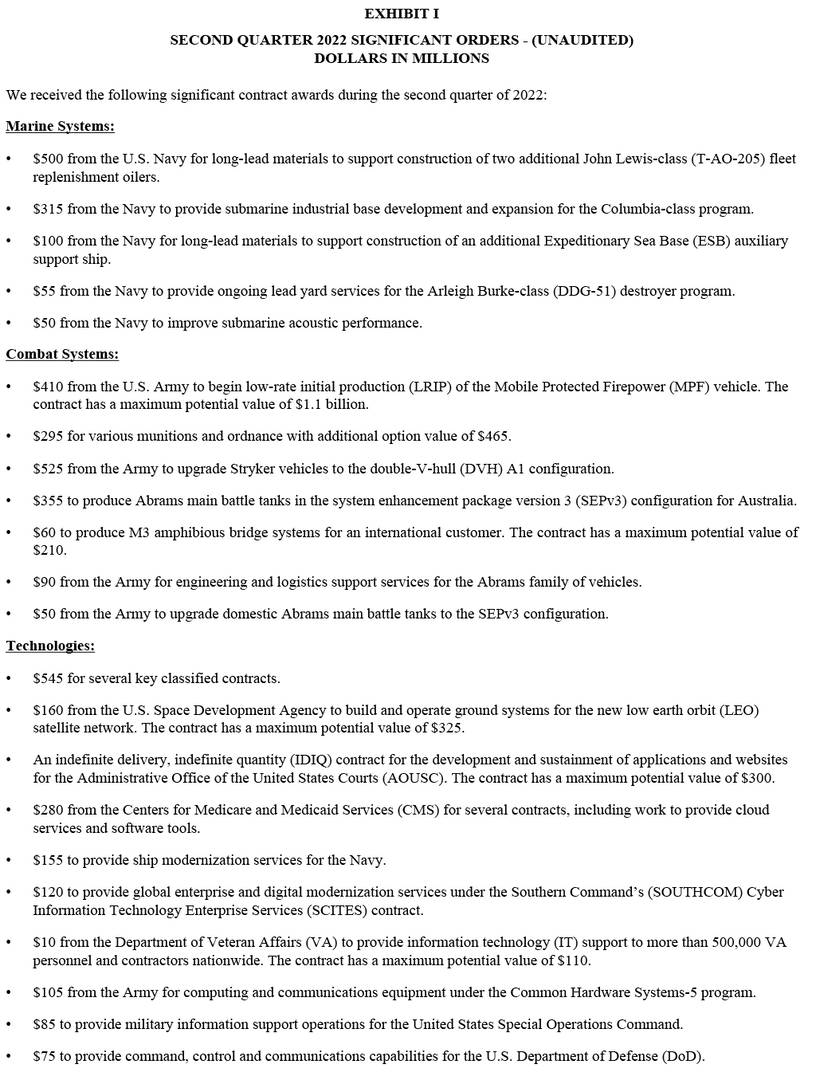

Significant awards in the quarter for the three defense segments included $410 million with a maximum potential value of $1.1 billion from the U.S. Army to begin low-rate initial production (LRIP) of the Mobile Protected Firepower vehicle; $295 million for various munitions and ordnance with additional option value of $465 million; $525 million from the Army to upgrade Stryker vehicles; $500 million from the U.S. Navy for long-lead materials to support construction of two additional John Lewis-class (T-AO-205) fleet replenishment oilers; $355 million to produce Abrams main battle tanks in the system enhancement package version 3 (SEPv3) configuration for Australia; $160 million with a maximum potential value of $325 million from the U.S. Space Development Agency to build and operate ground systems for the new low earth orbit (LEO) satellite network; $315 million from the Navy for submarine industrial base development and expansion for the Columbia-class submarine program; a contract with a maximum potential value of $300 million for development and sustainment of applications and websites for the Administrative Office of the United States Courts; and $545 million for several key classified contracts.

About General Dynamics

Headquartered in Reston, Virginia, General Dynamics is a global aerospace and defense company that offers a broad portfolio of products and services in business aviation; ship construction and repair; land combat vehicles, weapons systems and munitions; and technology products and services. General Dynamics employs more than 100,000 people worldwide and generated $38.5 billion in revenue in 2021. More information is available at www.gd.com.

Certain statements in this press release, including any statements about the company’s future operational and financial performance, may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Words such as “expects,” “anticipates,” “plans,” “believes,” “forecasts,” “scheduled,” “outlook,” “estimates,” “should” and variations of these words and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on management’s expectations, estimates, projections and assumptions. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors. Additional information regarding these factors is contained in the company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K. All forward-looking statements speak only as of the date they were made. The company does not undertake any obligation to update or publicly release revisions to any forward-looking statements to reflect events, circumstances or changes in expectations after the date of this press release.

WEBCAST INFORMATION: General Dynamics will webcast its second-quarter 2022 financial results conference call at 9 a.m. EDT on Wednesday, July 27, 2022. The webcast will be a listen-only audio event available at www.gd.com. An on-demand replay of the webcast will be available by telephone one hour after the end of the call and end on August 3, 2022, at 866-813-9403 (international: +44 204-525-0658); passcode 671446. Charts furnished to investors and securities analysts in connection with General Dynamics’ announcement of its financial results are available at www.gd.com.