- Strong fourth quarter performance in COVID environment

- $3.9 billion net cash provided by operating activities for the year, 122% of net earnings

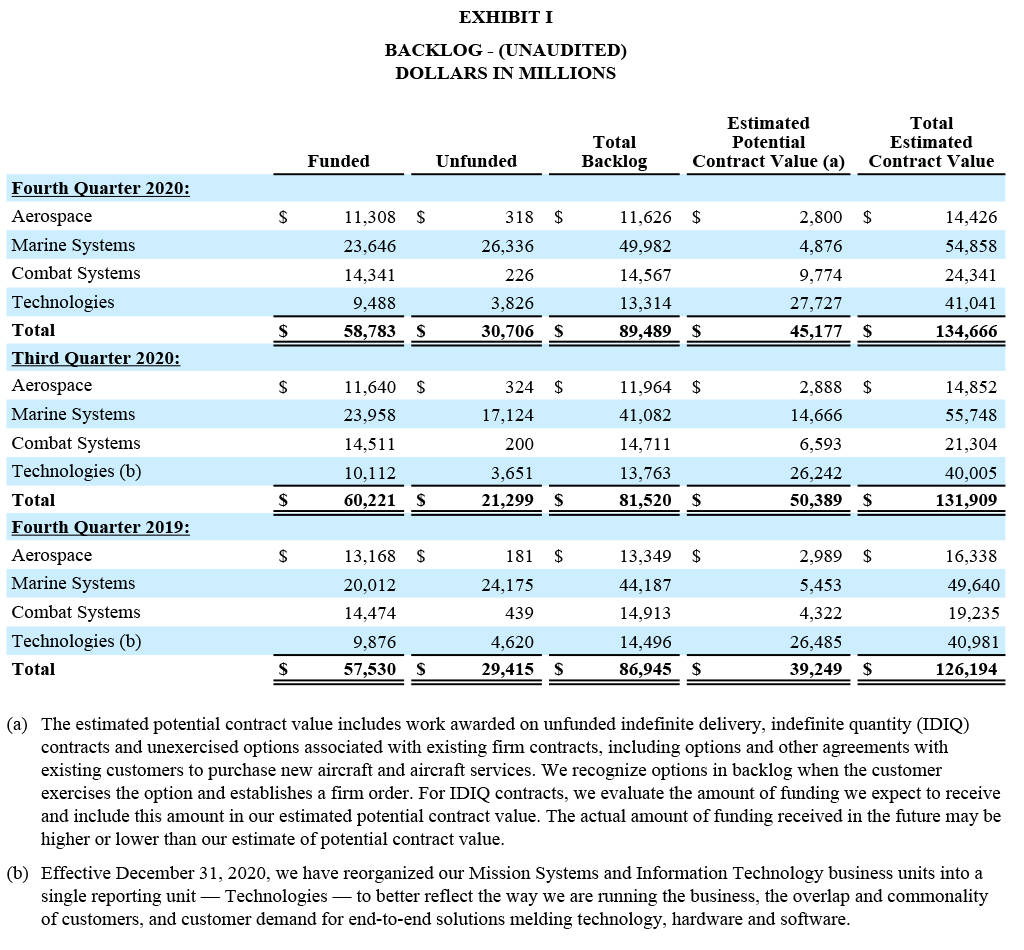

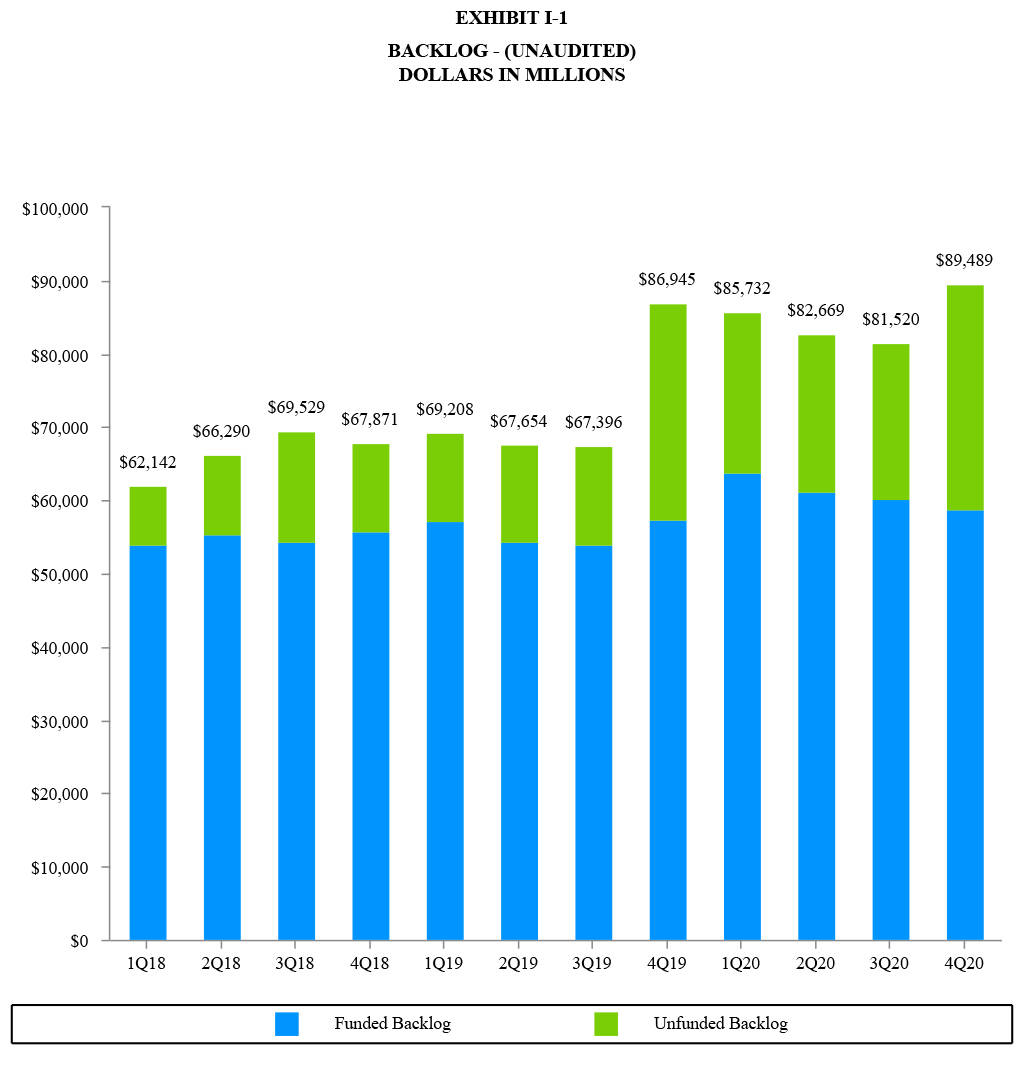

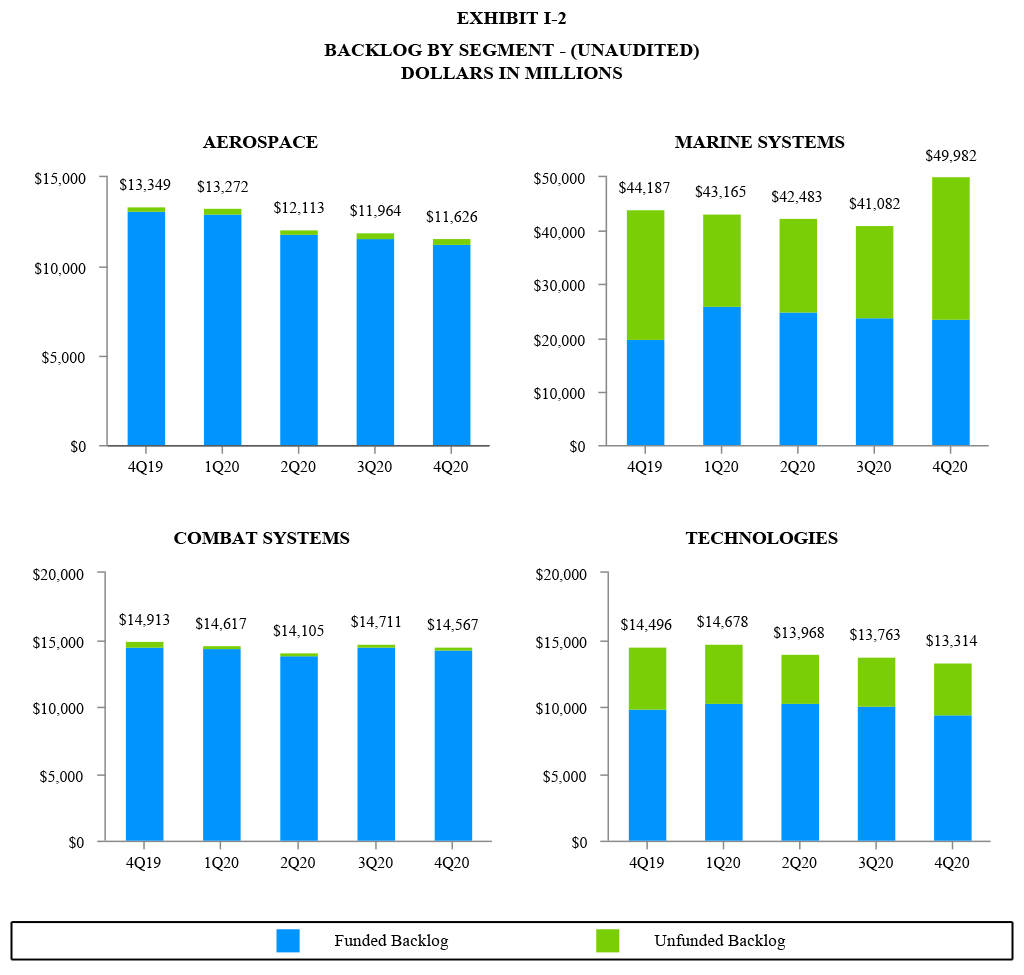

- Record-high backlog of $89.5 billion

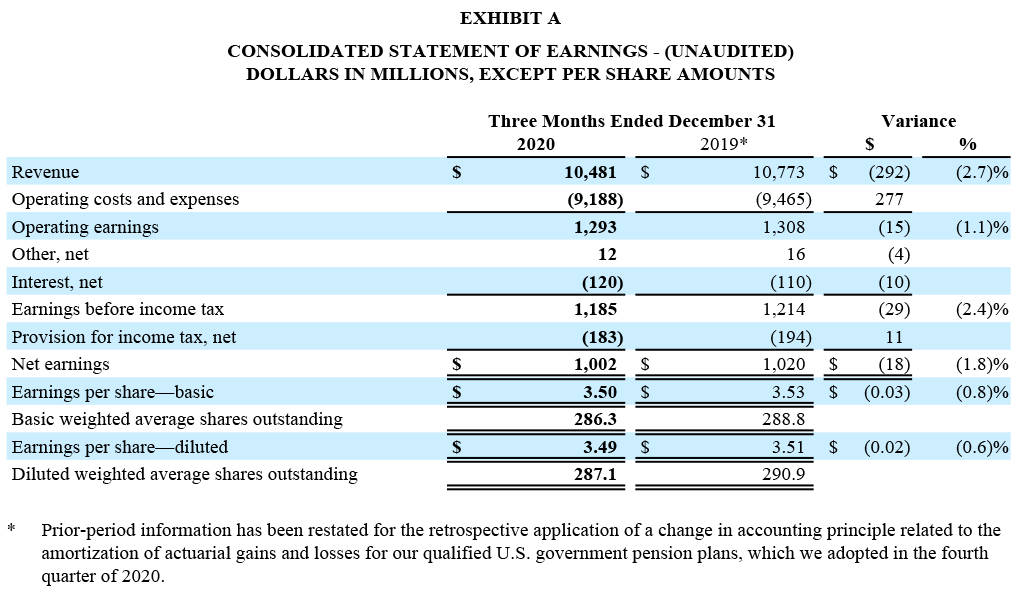

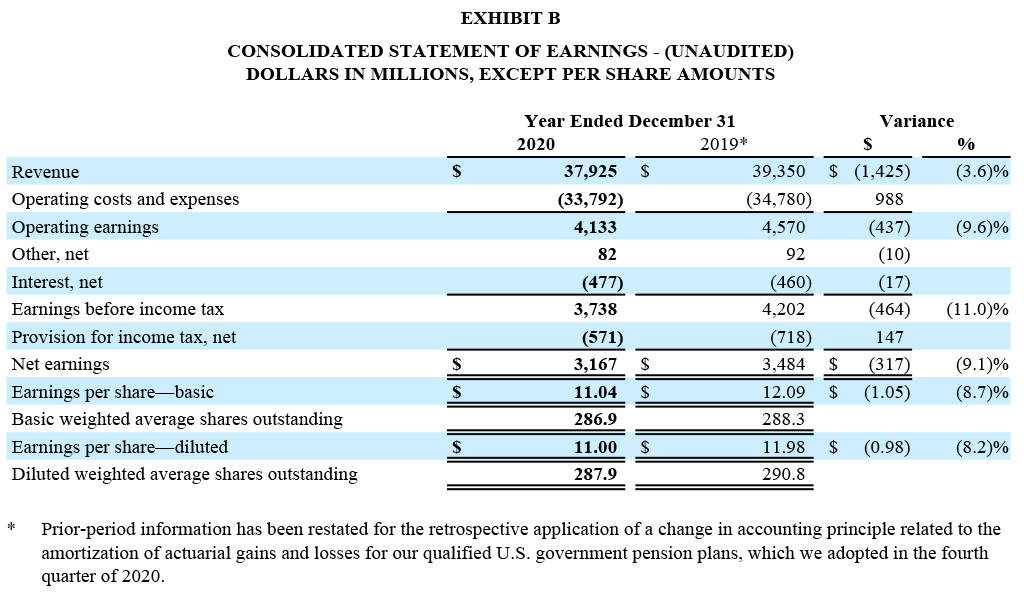

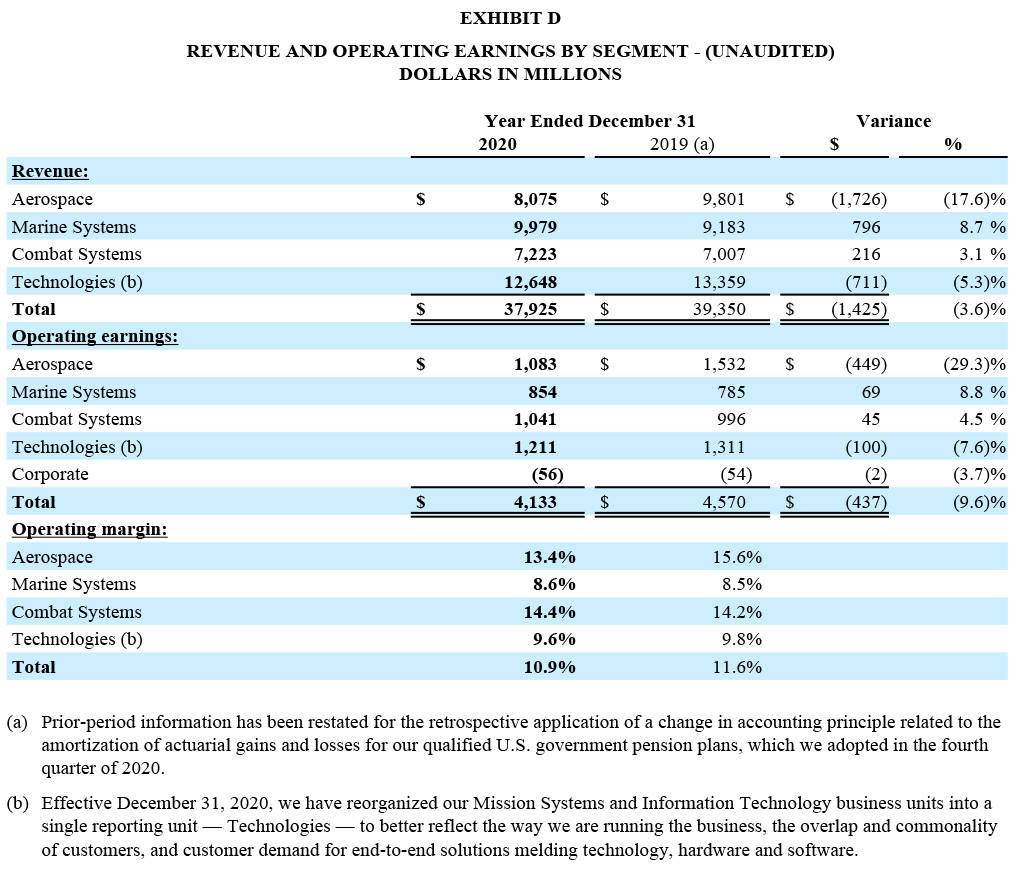

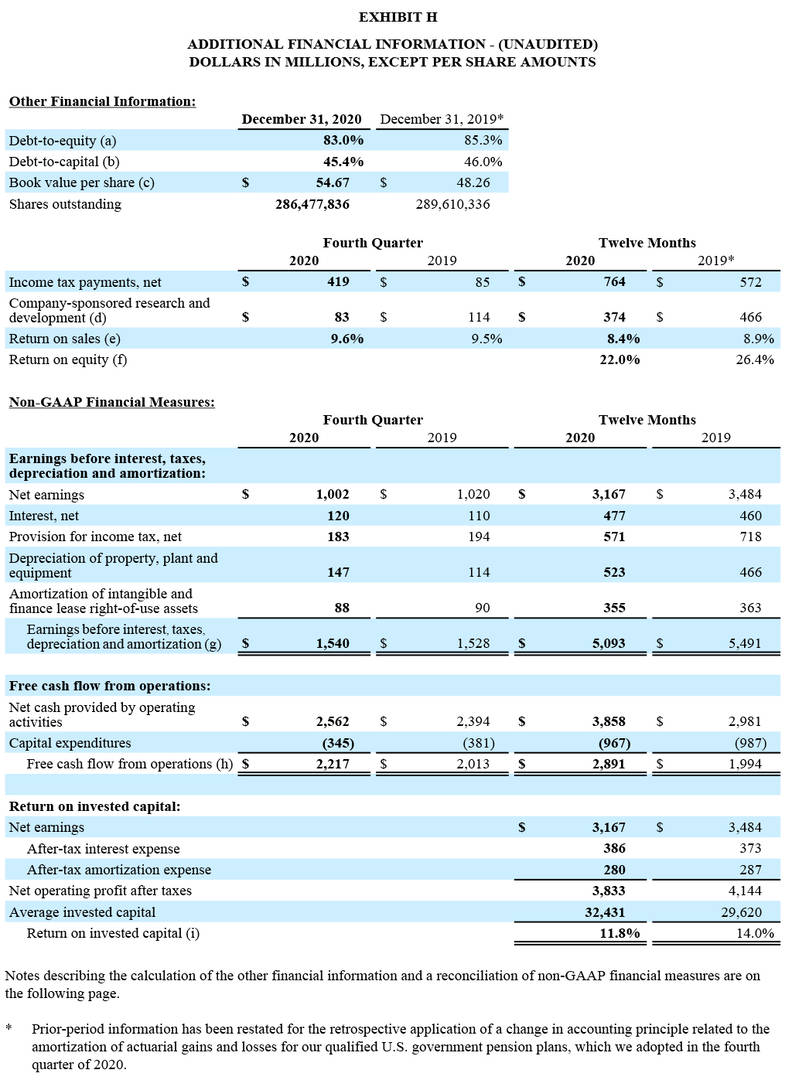

RESTON, Va. – General Dynamics (NYSE: GD) today reported quarterly net earnings of $1 billion, or $3.49 per diluted share, on $10.5 billion in revenue. For the full year, net earnings were $3.2 billion, or $11.00 per diluted share, on revenue of $37.9 billion.

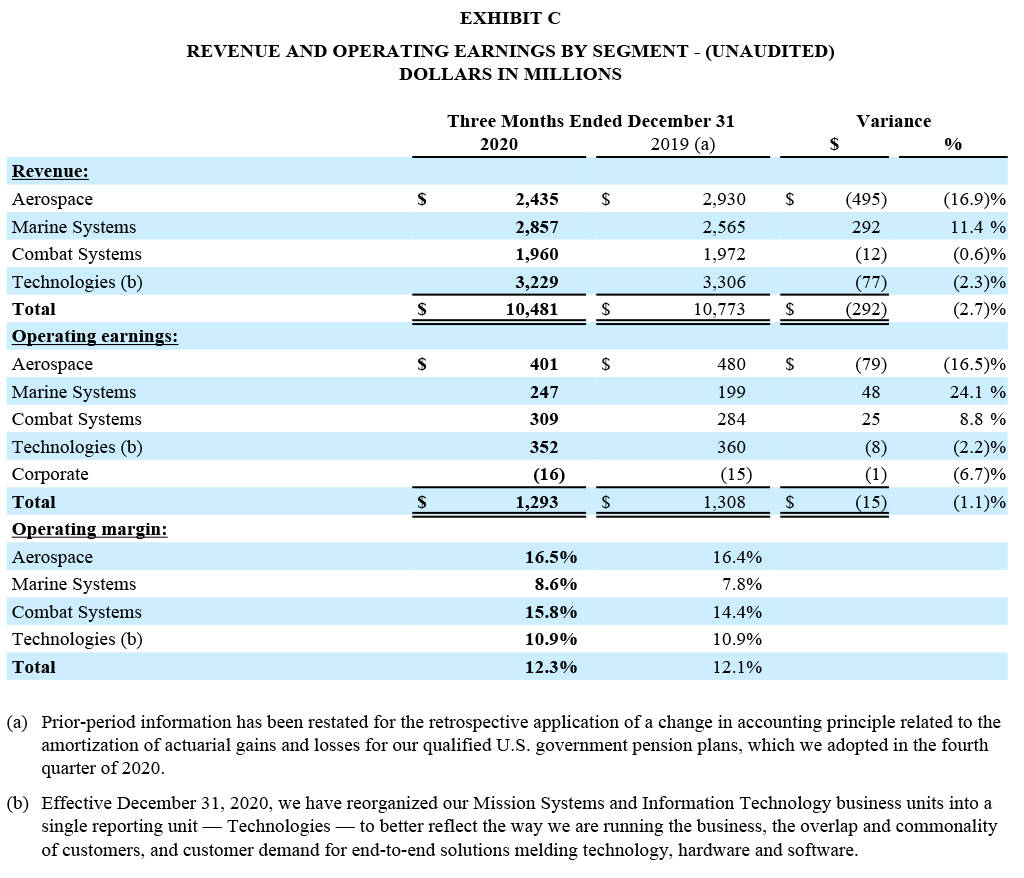

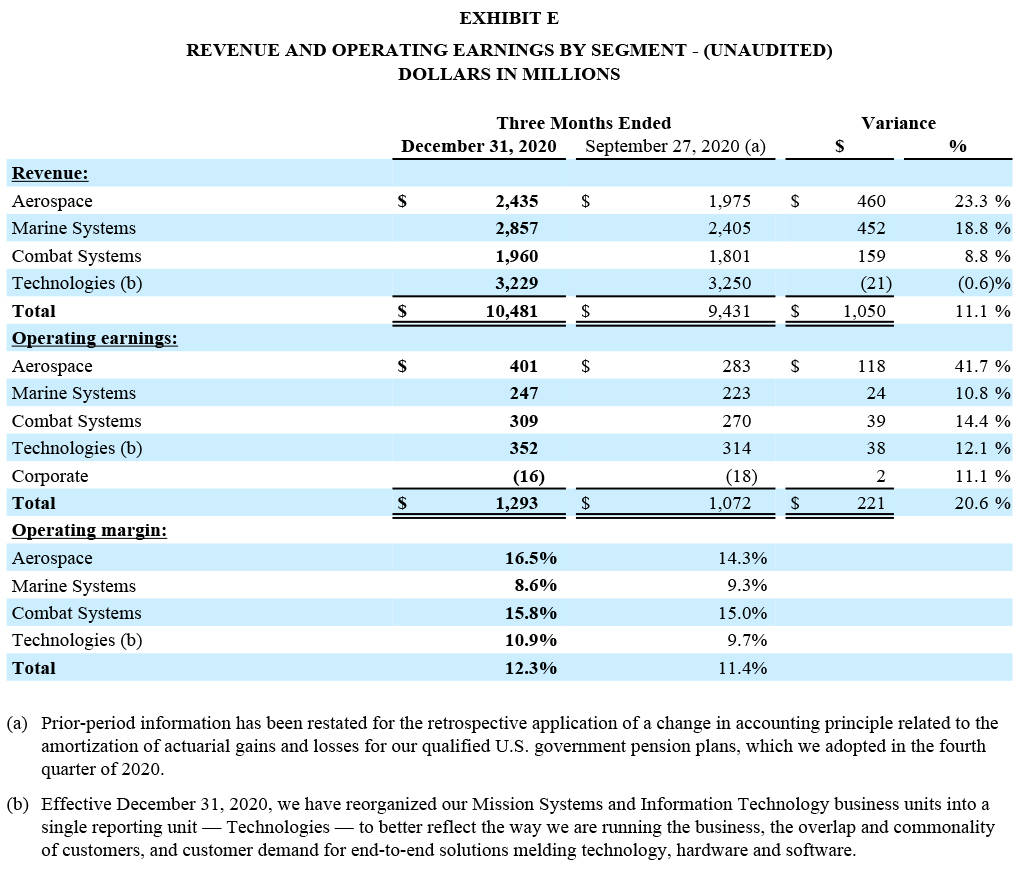

On a sequential basis, both net earnings and earnings per share (EPS) were up 20% from the previous quarter. Operating margin was 12.3% in the quarter, up 90 basis points sequentially and up 20 basis points from the year-ago quarter. Backlog grew 9.8% in the quarter to a record-high $89.5 billion.

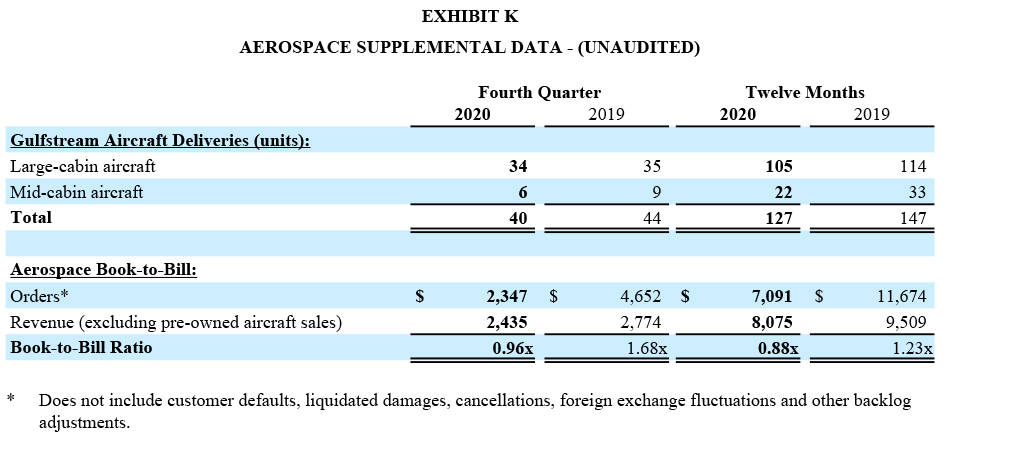

“Our continued focus on operating performance and on protecting the health and safety of our employees contributed to strong sequential improvements in earnings, margin and cash flow,” said Phebe N. Novakovic, chairman and chief executive officer. “Our defense segments continued to capture significant awards, leading to a record-high backlog, while our aerospace segment not only remained very profitable, but actually improved its margins throughout the year, even as the broader business aviation industry contracted severely due to the pandemic.”

Margin

Company-wide operating margin was 12.3%, up 90 basis points from the prior quarter. Aerospace margin was 16.5%, up 220 basis points from the prior quarter.

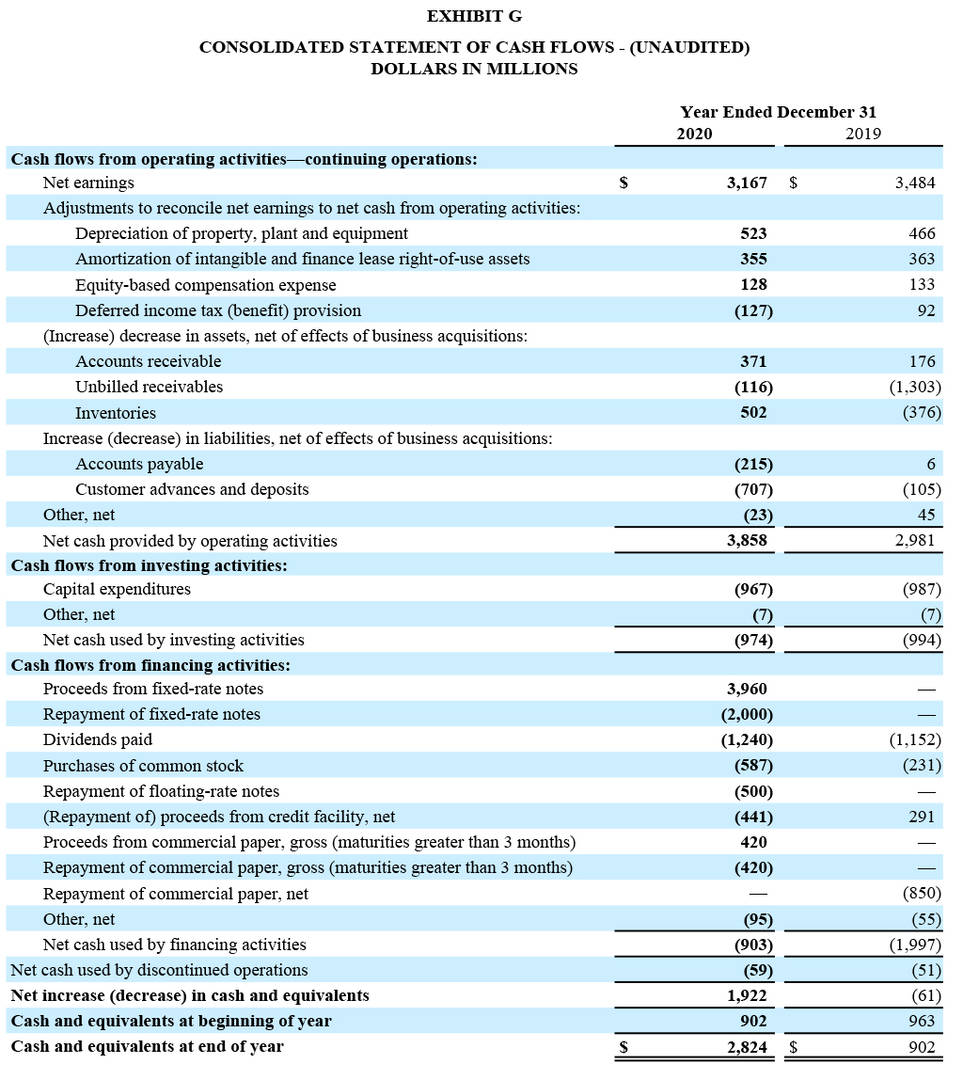

Cash

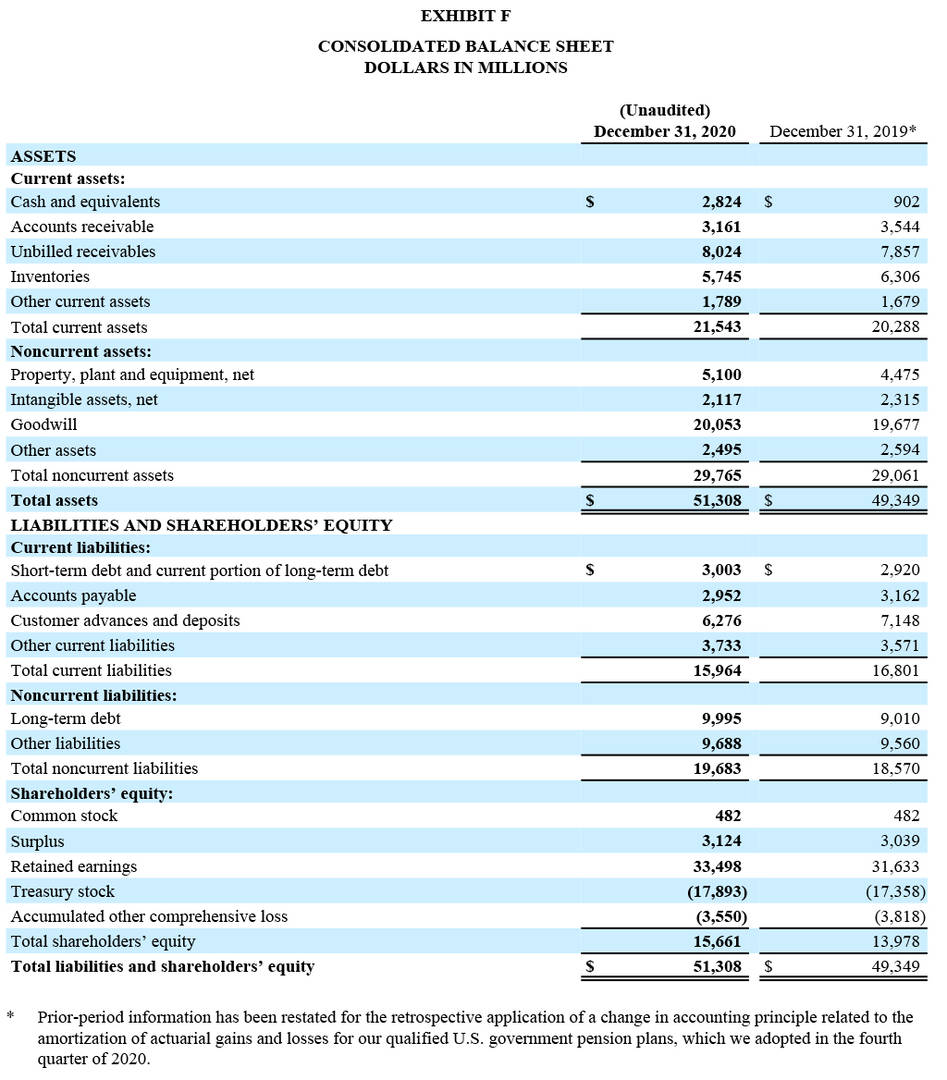

Net cash provided by operating activities in the quarter totaled $2.6 billion, or 256% of net earnings. For the year, net cash provided by operating activities totaled $3.9 billion, or 122% of net earnings. Free cash flow from operations, defined as net cash provided by operating activities less capital expenditures, was $2.2 billion for the quarter, a 221% conversion of net earnings, and $2.9 billion for the year, a 91% conversion of net earnings. During the quarter, the company reduced its net debt by $1.7 billion, invested $345 million in capital expenditures, paid $315 million in dividends, and repurchased $100.7 million in shares at an average price of $143.80, ending 2020 with $2.8 billion in cash and equivalents on hand.

Backlog

Orders remained strong across the company with a consolidated book-to-bill of 1.8-to-1 for the quarter and 1.1-to-1 for the year. In addition to backlog of $89.5 billion, management’s estimate of additional value in unfunded indefinite delivery/indefinite quantity (IDIQ) contracts and unexercised options was $45.2 billion at year-end. Total estimated contract value, representing the sum of all backlog components was $134.7 billion, up 6.7% for the year.

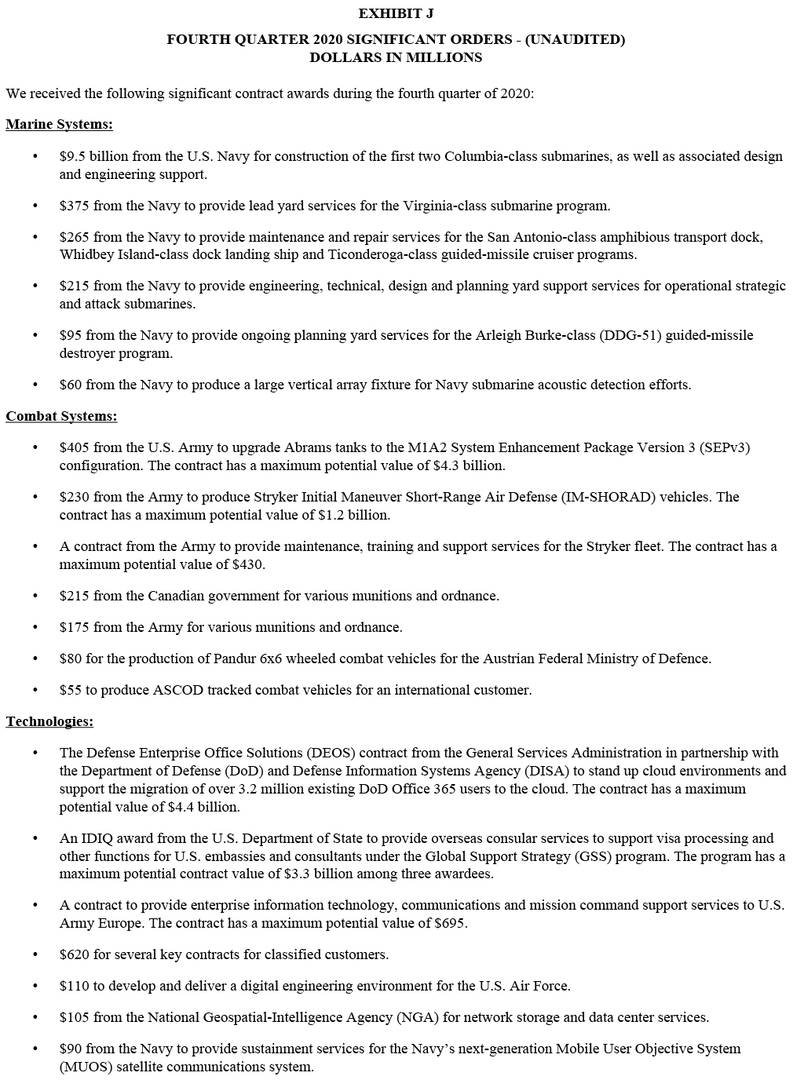

Significant awards in the fourth quarter included a $9.5 billion option exercise from the U.S. Navy for construction and test of the first two Columbia-class submarines; $4.4 billion maximum potential value contract from the U.S. Department of Defense to provide cloud solutions for Office 365 deployment and migration; a $3.3 billion maximum potential value contract from the U.S. State Department to provide business process support services; a $695 million contract from the U.S. Army to provide information technology and professional services; $620 million for several key contracts for classified customers; a $405 million initial task order on a $4.3 billion maximum potential value contract to upgrade Abrams tanks for the Army; a $230 million initial task order on an Army contract with a maximum potential contract value of $1.2 billion to produce Stryker Initial Maneuver Short-Range Air Defense (IM-SHORAD) vehicles; $375 million from the Navy to provide lead yard services for the Virginia-class submarine program; and $265 million from the Navy for maintenance and repair services for three ship classes.

About General Dynamics

Headquartered in Reston, Virginia, General Dynamics is a global aerospace and defense company that offers a broad portfolio of products and services in business aviation; ship construction and repair; land combat vehicles, weapons systems and munitions; and technology products and services. General Dynamics employs more than 100,000 people worldwide and generated $37.9 billion in revenue in 2020. More information is available at www.gd.com.

Certain statements made in this press release, including any statements as to future results of operations and financial projections, may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management’s expectations, estimates, projections and assumptions. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors. Additional information regarding these factors is contained in the company’s filings with the Securities and Exchange Commission, including, without limitation, its Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q and its Current Reports on Form 8-K. All forward-looking statements speak only as of the date they were made. The company does not undertake any obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this press release.

WEBCAST INFORMATION: General Dynamics will webcast its fourth-quarter and full-year 2020 financial results conference call at 9 a.m. EST on Wednesday, January 27, 2021. The webcast will be a listen-only audio event available at www.gd.com. An on-demand replay of the webcast will be available one hour after the end of the call and end on February 3, 2021. To hear a recording of the conference call by telephone, please call 877-344-7529 (international: 412-317-0088); passcode 10151195. Charts furnished to investors and securities analysts in connection with General Dynamics’ announcement of its financial results are available at www.gd.com. General Dynamics intends to supplement those charts on its website after its earnings call today to include information about 2021 guidance presented during the call.