- Revenue of $9.6 billion, up 4% year-over-year

- Diluted earnings per share of $2.77, up 5.7% year-over-year

- Gulfstream G600 achieves FAA certification

FALLS CHURCH, Va. – General Dynamics (NYSE: GD) today reported second-quarter 2019 revenue of $9.6 billion, up 4 percent year-over-year, with net earnings of $806 million. Diluted earnings per share were $2.77, an increase of 5.7 percent year-over-year.

Operating margins increased sequentially by 50 basis points over the previous quarter to 11.4 percent. In June, the all-new Gulfstream G600 earned both its type and production certificates from the U.S. Federal Aviation Administration.

“Our second-quarter results reflect our relentless focus on driving down costs and improving performance,” said Phebe Novakovic, chairman and chief executive officer. “That focus on performance remains unwavering as we ramp up production of new aircraft, begin construction of both a new block and new class of submarines, and solidify our market-leading position in Information Technology.”

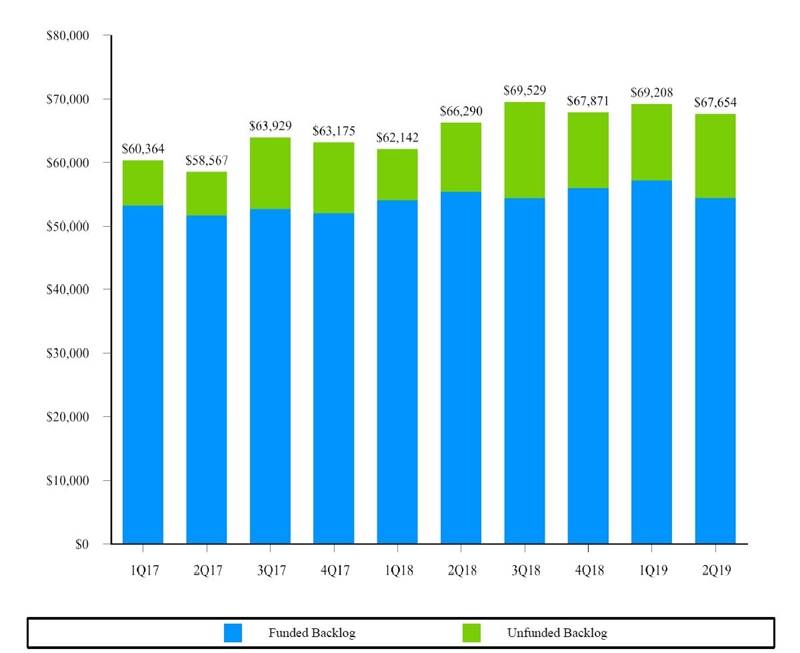

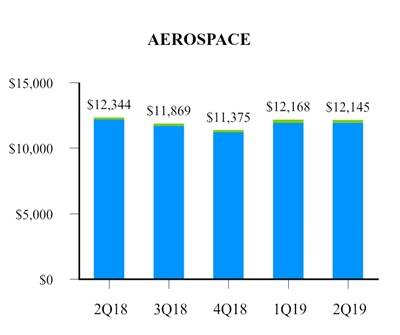

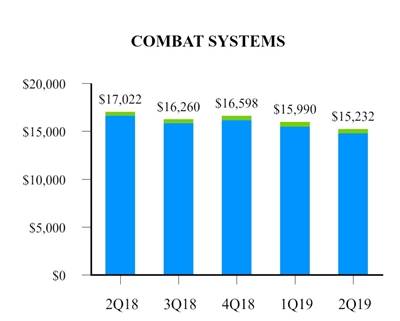

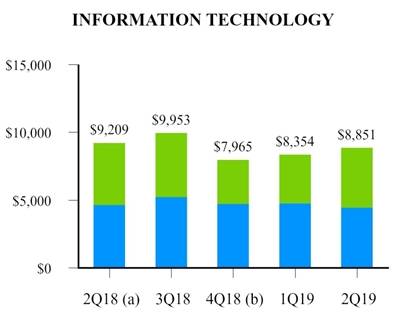

Backlog

General Dynamics’ total backlog at the end of second-quarter 2019 was $67.7 billion. Estimated potential contract value, representing management’s estimate of value in unfunded indefinite delivery, indefinite quantity (IDIQ) contracts and unexercised options, was $34.2 billion. Total estimated contract value, the sum of all backlog components, was $101.9 billion, up 3 percent year-over-year.

Order activity remained strong across the aerospace and defense portfolios. Aerospace booked $2.2 billion in orders in the quarter, a 1-to-1 book-to-bill on 12.7 percent year-over-year revenue growth. Significant awards in defense portfolios in the quarter included $495 million from the U.S. Navy for industrial base development and expansion in support of the Columbia-class ballistic missile submarine program, $360 million in contracts to provide intelligence services to classified customers, $270 million from the Navy to support the joint U.S. and U.K. development of the submarine Common Missile Compartment and $260 million from the U.S. Army for production of munitions. Information Technology posted a strong book-to-bill of 1.2-to-1, driven by a $1 billion U.S. Department of State contract to provide global engineering and supply chain services.

About General Dynamics

Headquartered in Falls Church, Virginia, General Dynamics is a global aerospace and defense company that offers a broad portfolio of products and services in business aviation; combat vehicles, weapons systems and munitions; IT services; C4ISR solutions; and shipbuilding and ship repair. General Dynamics employs more than 100,000 people worldwide and generated $36.2 billion in revenue in 2018. More information is available at www.generaldynamics.com.

Certain statements made in this press release, including any statements as to future results of operations and financial projections, may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management’s expectations, estimates, projections and assumptions. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual future results and trends may differ materially from what is forecast in forward-looking statements due to a variety of factors. Additional information regarding these factors is contained in the company’s filings with the Securities and Exchange Commission, including, without limitation, its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. All forward-looking statements speak only as of the date they were made. The company does not undertake any obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this press release.

WEBCAST INFORMATION: General Dynamics will webcast its second-quarter 2019 financial results conference call at 9 a.m. EDT on Wednesday, July 24, 2019. The webcast will be a listen-only audio event available at www.generaldynamics.com. An on-demand replay of the webcast will be available by 12 p.m. on July 24 and will continue for 12 months. To hear a recording of the conference call by telephone, please call 877-344-7529 (international: 412-317-0088); passcode 10132448. The phone replay will be available through August 1, 2019.

Charts furnished to investors and securities analysts in connection with General Dynamics’ announcement of its financial results for second-quarter 2019 are available at www.generaldynamics.com.

EXHIBIT A

|

|

Three Months Ended

|

Variance

|

||||||||||||

|

|

June 30, 2019

|

July 1, 2018*

|

$

|

%

|

||||||||||

|

Revenue

|

$

|

9,555

|

|

$

|

9,186

|

|

$

|

369

|

|

4.0

|

%

|

|||

|

Operating costs and expenses

|

(8,465

|

)

|

(8,098

|

)

|

(367

|

)

|

||||||||

|

Operating earnings

|

1,090

|

|

1,088

|

|

2

|

|

0.2

|

%

|

||||||

|

Interest, net

|

(119

|

)

|

(103

|

)

|

(16

|

)

|

||||||||

|

Other, net

|

12

|

|

(15

|

)

|

27

|

|

||||||||

|

Earnings before income tax

|

983

|

|

|

970

|

|

|

13

|

|

1.3

|

%

|

||||

|

Provision for income tax, net

|

(177

|

)

|

(184

|

)

|

7

|

|

||||||||

|

Net earnings

|

$

|

806

|

|

|

$

|

786

|

|

|

$

|

20

|

|

2.5

|

%

|

|

|

Earnings per share—basic

|

$

|

2.80

|

|

|

$

|

2.65

|

|

|

$

|

0.15

|

|

5.7

|

%

|

|

|

Basic weighted average shares outstanding

|

288.1

|

|

296.2

|

|

|

|

|

|

||||||

|

Earnings per share—diluted

|

$

|

2.77

|

|

|

$

|

2.62

|

|

|

$

|

0.15

|

|

5.7

|

%

|

|

|

Diluted weighted average shares outstanding

|

290.8

|

|

300.1

|

|

||||||||||

|

*

|

2018 results include the unfavorable impact of one-time charges of approximately $70 associated with costs to complete the acquisition of CSRA Inc. In the table above, approximately $45 of compensation-related costs was reported in operating costs and expenses, and approximately $25 of transaction costs was reported in other, net.

|

|

|

Six Months Ended

|

Variance

|

||||||||||||

|

|

June 30, 2019

|

July 1, 2018*

|

$

|

%

|

||||||||||

|

Revenue

|

$

|

18,816

|

|

$

|

16,721

|

|

$

|

2,095

|

|

12.5

|

%

|

|||

|

Operating costs and expenses

|

(16,712

|

)

|

(14,625

|

)

|

(2,087

|

)

|

||||||||

|

Operating earnings

|

2,104

|

|

2,096

|

|

8

|

|

0.4

|

%

|

||||||

|

Interest, net

|

(236

|

)

|

(130

|

)

|

(106

|

)

|

||||||||

|

Other, net

|

30

|

|

(36

|

)

|

66

|

|

||||||||

|

Earnings before income tax

|

1,898

|

|

|

1,930

|

|

(32

|

)

|

(1.7

|

)%

|

|||||

|

Provision for income tax, net

|

(347

|

)

|

(345

|

)

|

(2

|

)

|

||||||||

|

Net earnings

|

$

|

1,551

|

|

$

|

1,585

|

|

$

|

(34

|

)

|

(2.1

|

)%

|

|||

|

Earnings per share—basic

|

$

|

5.39

|

|

$

|

5.35

|

|

$

|

0.04

|

|

0.7

|

%

|

|||

|

Basic weighted average shares outstanding

|

288.0

|

|

296.3

|

|

|

|

||||||||

|

Earnings per share—diluted

|

$

|

5.33

|

|

$

|

5.27

|

|

$

|

0.06

|

|

1.1

|

%

|

|||

|

Diluted weighted average shares outstanding

|

290.8

|

|

300.6

|

|

||||||||||

|

*

|

2018 results include the unfavorable impact of one-time charges of approximately $75 associated with costs to complete the acquisition of CSRA Inc. In the table above, approximately $45 of compensation-related costs was reported in operating costs and expenses, and approximately $30 of transaction costs was reported in other, net.

|

|

|

Three Months Ended

|

Variance

|

||||||||||||

|

|

June 30, 2019

|

July 1, 2018*

|

$

|

%

|

||||||||||

|

Revenue:

|

||||||||||||||

|

Aerospace

|

$

|

2,136

|

|

$

|

1,895

|

|

$

|

241

|

|

12.7

|

%

|

|||

|

Combat Systems

|

1,659

|

|

1,534

|

|

125

|

|

8.1

|

%

|

||||||

|

Information Technology

|

2,158

|

|

2,442

|

|

(284

|

)

|

(11.6

|

)%

|

||||||

|

Mission Systems

|

1,277

|

|

1,147

|

|

130

|

|

11.3

|

%

|

||||||

|

Marine Systems

|

2,325

|

|

2,168

|

|

157

|

|

7.2

|

%

|

||||||

|

Total

|

$

|

9,555

|

|

|

$

|

9,186

|

|

|

$

|

369

|

|

4.0

|

%

|

|

|

Operating earnings:

|

||||||||||||||

|

Aerospace

|

$

|

331

|

|

$

|

386

|

|

$

|

(55

|

)

|

(14.2

|

)%

|

|||

|

Combat Systems

|

242

|

|

236

|

|

6

|

|

2.5

|

%

|

||||||

|

Information Technology

|

154

|

|

156

|

|

(2

|

)

|

(1.3

|

)%

|

||||||

|

Mission Systems

|

162

|

|

153

|

|

9

|

|

5.9

|

%

|

||||||

|

Marine Systems

|

197

|

|

195

|

|

2

|

|

1.0

|

%

|

||||||

|

Corporate

|

4

|

|

(38

|

)

|

42

|

|

110.5

|

%

|

||||||

|

Total

|

$

|

1,090

|

|

|

$

|

1,088

|

|

|

$

|

2

|

|

0.2

|

%

|

|

|

Operating margin:

|

||||||||||||||

|

Aerospace

|

15.5

|

%

|

20.4

|

%

|

||||||||||

|

Combat Systems

|

14.6

|

%

|

15.4

|

%

|

||||||||||

|

Information Technology

|

7.1

|

%

|

6.4

|

%

|

||||||||||

|

Mission Systems

|

12.7

|

%

|

13.3

|

%

|

||||||||||

|

Marine Systems

|

8.5

|

%

|

9.0

|

%

|

||||||||||

|

Total

|

11.4

|

%

|

11.8

|

%

|

||||||||||

|

*

|

2018 results include the unfavorable impact of approximately $45 of compensation-related one-time charges associated with costs to complete the acquisition of CSRA Inc. This amount was reported as a reduction of Corporate operating earnings in the table above.

|

|

|

Six Months Ended

|

Variance

|

||||||||||||

|

|

June 30, 2019

|

|

July 1, 2018*

|

$

|

%

|

|||||||||

|

Revenue:

|

|

|

|

|||||||||||

|

Aerospace

|

$

|

4,376

|

|

|

$

|

3,720

|

|

$

|

656

|

|

17.6

|

%

|

||

|

Combat Systems

|

3,295

|

|

|

2,974

|

|

321

|

|

10.8

|

%

|

|||||

|

Information Technology

|

4,327

|

|

3,580

|

|

747

|

|

20.9

|

%

|

||||||

|

Mission Systems

|

2,435

|

|

|

2,245

|

|

190

|

|

8.5

|

%

|

|||||

|

Marine Systems

|

4,383

|

|

|

4,202

|

|

181

|

|

4.3

|

%

|

|||||

|

Total

|

$

|

18,816

|

|

$

|

16,721

|

|

$

|

2,095

|

|

12.5

|

%

|

|||

|

Operating earnings:

|

|

|

|

|||||||||||

|

Aerospace

|

$

|

659

|

|

|

$

|

732

|

|

$

|

(73

|

)

|

(10.0

|

)%

|

||

|

Combat Systems

|

448

|

|

|

460

|

|

(12

|

)

|

(2.6

|

)%

|

|||||

|

Information Technology

|

310

|

|

257

|

|

53

|

|

20.6

|

%

|

||||||

|

Mission Systems

|

310

|

|

|

299

|

|

11

|

|

3.7

|

%

|

|||||

|

Marine Systems

|

377

|

|

|

379

|

|

(2

|

)

|

(0.5

|

)%

|

|||||

|

Corporate

|

—

|

|

|

(31

|

)

|

31

|

|

100.0

|

%

|

|||||

|

Total

|

$

|

2,104

|

|

|

$

|

2,096

|

|

|

$

|

8

|

|

0.4

|

%

|

|

|

Operating margin:

|

||||||||||||||

|

Aerospace

|

15.1

|

%

|

19.7

|

%

|

||||||||||

|

Combat Systems

|

13.6

|

%

|

15.5

|

%

|

||||||||||

|

Information Technology

|

7.2

|

%

|

7.2

|

%

|

||||||||||

|

Mission Systems

|

12.7

|

%

|

13.3

|

%

|

||||||||||

|

Marine Systems

|

8.6

|

%

|

9.0

|

%

|

||||||||||

|

Total

|

11.2

|

%

|

12.5

|

%

|

||||||||||

|

*

|

2018 results include the unfavorable impact of approximately $45 of compensation-related one-time charges associated with costs to complete the acquisition of CSRA Inc. This amount was reported as a reduction of Corporate operating earnings in the table above.

|

|

(Unaudited)

|

|||||||

|

June 30, 2019

|

December 31, 2018

|

||||||

|

ASSETS

|

|||||||

|

Current assets:

|

|||||||

|

Cash and equivalents

|

$

|

702

|

|

$

|

963

|

|

|

|

Accounts receivable

|

3,673

|

|

3,759

|

|

|||

|

Unbilled receivables

|

7,554

|

|

6,576

|

|

|||

|

Inventories

|

6,480

|

|

5,977

|

|

|||

|

Other current assets

|

1,148

|

|

914

|

|

|||

|

Total current assets

|

19,557

|

|

18,189

|

|

|||

|

Noncurrent assets:

|

|||||||

|

Property, plant and equipment, net

|

4,091

|

|

3,978

|

|

|||

|

Intangible assets, net

|

2,457

|

|

2,585

|

|

|||

|

Goodwill

|

19,662

|

|

19,594

|

|

|||

|

Other assets

|

2,307

|

|

1,062

|

|

|||

|

Total noncurrent assets

|

28,517

|

|

27,219

|

|

|||

|

Total assets

|

$

|

48,074

|

|

$

|

45,408

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Short-term debt and current portion of long-term debt

|

$

|

4,960

|

|

$

|

973

|

|

|

|

Accounts payable

|

2,860

|

|

3,179

|

|

|||

|

Customer advances and deposits

|

6,714

|

|

7,270

|

|

|||

|

Other current liabilities

|

3,480

|

|

3,317

|

|

|||

|

Total current liabilities

|

18,014

|

|

14,739

|

|

|||

|

Noncurrent liabilities:

|

|||||||

|

Long-term debt

|

8,975

|

|

11,444

|

|

|||

|

Other liabilities

|

8,208

|

|

7,493

|

|

|||

|

Total noncurrent liabilities

|

17,183

|

|

18,937

|

|

|||

|

Shareholders’ equity:

|

|||||||

|

Common stock

|

482

|

|

482

|

|

|||

|

Surplus

|

2,959

|

|

2,946

|

|

|||

|

Retained earnings

|

30,291

|

|

29,326

|

|

|||

|

Treasury stock

|

(17,379

|

)

|

(17,244

|

)

|

|||

|

Accumulated other comprehensive loss

|

(3,476

|

)

|

(3,778

|

)

|

|||

|

Total shareholders’ equity

|

12,877

|

|

11,732

|

|

|||

|

Total liabilities and shareholders’ equity

|

$

|

48,074

|

|

$

|

45,408

|

|

|

|

|

Six Months Ended

|

||||||

|

|

June 30, 2019

|

July 1, 2018

|

|||||

|

Cash flows from operating activities—continuing operations:

|

|||||||

|

Net earnings

|

$

|

1,551

|

|

$

|

1,585

|

|

|

|

Adjustments to reconcile net earnings to net cash from operating activities:

|

|||||||

|

Depreciation of property, plant and equipment

|

232

|

|

206

|

|

|||

|

Amortization of intangible and finance lease right-of-use assets

|

183

|

|

121

|

|

|||

|

Equity-based compensation expense

|

72

|

|

71

|

|

|||

|

Deferred income tax benefit

|

(17

|

)

|

(6

|

)

|

|||

|

(Increase) decrease in assets, net of effects of business acquisitions:

|

|||||||

|

Accounts receivable

|

64

|

|

344

|

|

|||

|

Unbilled receivables

|

(1,074

|

)

|

(1,030

|

)

|

|||

|

Inventories

|

(556

|

)

|

(542

|

)

|

|||

|

Increase (decrease) in liabilities, net of effects of business acquisitions:

|

|||||||

|

Accounts payable

|

(301

|

)

|

(324

|

)

|

|||

|

Customer advances and deposits

|

(607

|

)

|

(159

|

)

|

|||

|

Other, net

|

(51

|

)

|

25

|

|

|||

|

Net cash (used) provided by operating activities

|

(504

|

)

|

291

|

|

|||

|

Cash flows from investing activities:

|

|||||||

|

Capital expenditures

|

(362

|

)

|

(279

|

)

|

|||

|

Business acquisitions, net of cash acquired

|

(17

|

)

|

(10,039

|

)

|

|||

|

Other, net

|

16

|

|

74

|

|

|||

|

Net cash used by investing activities

|

(363

|

)

|

(10,244

|

)

|

|||

|

Cash flows from financing activities:

|

|||||||

|

Proceeds from commercial paper, net

|

1,394

|

|

2,786

|

|

|||

|

Dividends paid

|

(563

|

)

|

(526

|

)

|

|||

|

Purchases of common stock

|

(231

|

)

|

(436

|

)

|

|||

|

Proceeds from fixed-rate notes

|

—

|

|

6,461

|

|

|||

|

Proceeds from floating-rate notes

|

—

|

|

1,000

|

|

|||

|

Repayment of CSRA accounts receivable purchase agreement

|

—

|

|

(450

|

)

|

|||

|

Other, net

|

30

|

|

3

|

|

|||

|

Net cash provided by financing activities

|

630

|

|

8,838

|

|

|||

|

Net cash used by discontinued operations

|

(24

|

)

|

(6

|

)

|

|||

|

Net decrease in cash and equivalents

|

(261

|

)

|

(1,121

|

)

|

|||

|

Cash and equivalents at beginning of period

|

963

|

|

2,983

|

|

|||

|

Cash and equivalents at end of period

|

$

|

702

|

|

$

|

1,862

|

|

|

|

2019

|

2018

|

|||||||||||||||

|

|

Second Quarter

|

|

Second Quarter

|

|

||||||||||||

|

Other Financial Information:

|

||||||||||||||||

|

Debt-to-equity (a)

|

108.2

|

%

|

119.0

|

%

|

||||||||||||

|

Debt-to-capital (b)

|

52.0

|

%

|

54.3

|

%

|

||||||||||||

|

Book value per share (c)

|

$

|

44.58

|

|

$

|

40.48

|

|

||||||||||

|

Income tax payments, net

|

$

|

360

|

|

$

|

159

|

|

||||||||||

|

Company-sponsored research and development (d)

|

$

|

120

|

|

$

|

90

|

|

||||||||||

|

Shares outstanding

|

288,844,120

|

|

296,281,432

|

|

||||||||||||

|

Non-GAAP Financial Measures:

|

||||||||||||||||

|

2019

|

2018

|

|||||||||||||||

|

|

Second Quarter

|

Six Months

|

Second Quarter

|

Six Months

|

||||||||||||

|

Earnings before interest, taxes, depreciation

and amortization:

|

||||||||||||||||

|

Net earnings

|

$

|

806

|

|

$

|

1,551

|

|

$

|

786

|

|

$

|

1,585

|

|

||||

|

Interest, net

|

119

|

|

236

|

|

103

|

|

130

|

|

||||||||

|

Provision for income tax, net

|

177

|

|

347

|

|

184

|

|

345

|

|

||||||||

|

Depreciation of property, plant and equipment

|

118

|

|

232

|

|

117

|

|

206

|

|

||||||||

|

Amortization of intangible and finance lease right-of-use assets

|

92

|

|

183

|

|

101

|

|

121

|

|

||||||||

|

Earnings before interest, taxes, depreciation

and amortization (e)

|

$

|

1,312

|

|

$

|

2,549

|

|

$

|

1,291

|

|

$

|

2,387

|

|

||||

|

Free cash flow from operations:

|

||||||||||||||||

|

Net cash provided (used) by operating activities

|

$

|

291

|

|

$

|

(504

|

)

|

$

|

787

|

|

$

|

291

|

|

||||

|

Capital expenditures

|

(181

|

)

|

(362

|

)

|

(175

|

)

|

(279

|

)

|

||||||||

|

Free cash flow from operations (f)

|

$

|

110

|

|

$

|

(866

|

)

|

$

|

612

|

|

$

|

12

|

|

||||

|

(a)

|

Debt-to-equity ratio is calculated as total debt divided by total equity as of the end of the period.

|

|

(b)

|

Debt-to-capital ratio is calculated as total debt divided by the sum of total debt plus total equity as of the end of the period.

|

|

(c)

|

Book value per share is calculated as total equity divided by total outstanding shares as of the end of the period.

|

|

(d)

|

Includes independent research and development and Aerospace product-development costs.

|

|

(e)

|

We believe earnings before interest, taxes, depreciation and amortization (EBITDA) is a useful measure for investors because it provides another measure of our profitability and our ability to service our debt. We calculate EBITDA by adding back interest, taxes, depreciation and amortization to net earnings. The most directly comparable GAAP measure to EBITDA is net earnings.

|

|

(f)

|

We believe free cash flow from operations is a useful measure for investors because it portrays our ability to generate cash from our businesses for purposes such as repaying maturing debt, funding business acquisitions, repurchasing our common stock and paying dividends. We use free cash flow from operations to assess the quality of our earnings and as a key performance measure in evaluating management. The most directly comparable GAAP measure to free cash flow from operations is net cash provided by operating activities.

|

|

Funded

|

Unfunded

|

Total

Backlog

|

Estimated

Potential

Contract Value*

|

Total Estimated

Contract

Value

|

||||||||||||||||

|

Second Quarter 2019:

|

||||||||||||||||||||

|

Aerospace

|

$

|

11,932

|

|

$

|

213

|

|

$

|

12,145

|

|

$

|

2,079

|

|

$

|

14,224

|

|

|||||

|

Combat Systems

|

14,794

|

|

438

|

|

15,232

|

|

4,113

|

|

19,345

|

|

||||||||||

|

Information Technology

|

4,446

|

|

4,405

|

|

8,851

|

|

17,983

|

|

26,834

|

|

||||||||||

|

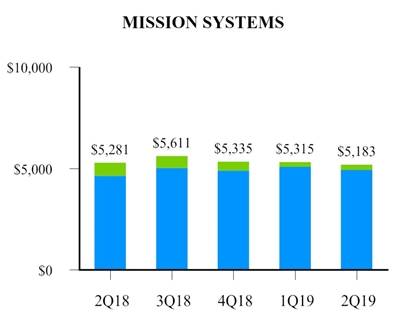

Mission Systems

|

4,925

|

|

258

|

|

5,183

|

|

6,847

|

|

12,030

|

|

||||||||||

|

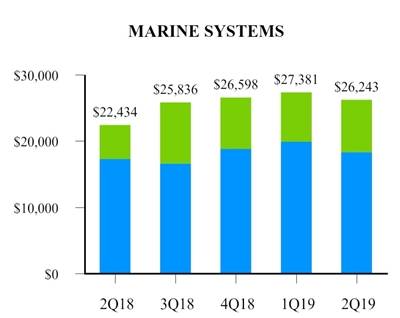

Marine Systems

|

18,344

|

|

7,899

|

|

26,243

|

|

3,223

|

|

29,466

|

|

||||||||||

|

Total

|

$

|

54,441

|

|

$

|

13,213

|

|

$

|

67,654

|

|

$

|

34,245

|

|

$

|

101,899

|

|

|||||

|

First Quarter 2019:

|

||||||||||||||||||||

|

Aerospace

|

$

|

11,924

|

|

$

|

244

|

|

$

|

12,168

|

|

$

|

2,080

|

|

$

|

14,248

|

|

|||||

|

Combat Systems

|

15,475

|

|

515

|

|

15,990

|

|

4,185

|

|

20,175

|

|

||||||||||

|

Information Technology

|

4,770

|

|

3,584

|

|

8,354

|

|

16,666

|

|

25,020

|

|

||||||||||

|

Mission Systems

|

5,081

|

|

234

|

|

5,315

|

|

7,186

|

|

12,501

|

|

||||||||||

|

Marine Systems

|

19,935

|

|

7,446

|

|

27,381

|

|

3,831

|

|

31,212

|

|

||||||||||

|

Total

|

$

|

57,185

|

|

$

|

12,023

|

|

$

|

69,208

|

|

$

|

33,948

|

|

$

|

103,156

|

|

|||||

|

Second Quarter 2018:

|

||||||||||||||||||||

|

Aerospace

|

$

|

12,187

|

|

$

|

157

|

|

$

|

12,344

|

|

$

|

2,282

|

|

$

|

14,626

|

|

|||||

|

Combat Systems

|

16,646

|

|

376

|

|

17,022

|

|

2,840

|

|

19,862

|

|

||||||||||

|

Information Technology

|

4,633

|

|

4,576

|

|

9,209

|

|

18,931

|

|

28,140

|

|

||||||||||

|

Mission Systems

|

4,636

|

|

645

|

|

5,281

|

|

4,287

|

|

9,568

|

|

||||||||||

|

Marine Systems

|

17,310

|

|

5,124

|

|

22,434

|

|

4,333

|

|

26,767

|

|

||||||||||

|

Total

|

$

|

55,412

|

|

$

|

10,878

|

|

$

|

66,290

|

|

$

|

32,673

|

|

$

|

98,963

|

|

|||||

|

Funded Backlog

|

Unfunded Backlog

|

|||||||||

|

(a) Reflects the acquisition of CSRA.

|

||||||||||

|

(b) Reflects the divestiture of a public-facing contact-center business.

|

||||||||||

Combat Systems:

- $260 from the U.S. Army for munitions production. The program has a maximum potential contract value of $1.6 billion.

- $100 for the production of various high-performance warheads.

- $60 for the production of control actuator systems for the Excalibur artillery system.

- $35 from the Army for various rounds of medium-caliber ammunition.

- $25 from the Army to provide systems technical support for Abrams main battle tanks.

Information Technology:

- $1 billion from the U.S. Department of State to provide global security engineering and supply chain management services. The program has a maximum potential contract value of over $2 billion.

- $360 for several key contracts to provide intelligence services to classified customers.

- A contract to provide network monitoring, network engineering and system administration services for the U.S. Air Force. The program has a maximum potential value of approximately $215.

- $85 from the Centers for Medicare and Medicaid Services (CMS) for cloud hosting support services.

- $70 from the CMS to provide hosting, operations and maintenance services for the agency’s Healthcare Integrated General Ledger Accounting System (HIGLAS) application.

- $50 from the U.S. Navy to provide training and training-related program support.

- $45 from the CMS for benefits recovery services. The program has a maximum potential contract value of $275.

Mission Systems:

- $90 to provide maintenance and support services for the United Kingdom’s Bowman tactical communications system.

- $80 from the Army for computing and communications equipment under the Common Hardware Systems-5 (CHS-5) program.

- $80 to provide engineering and support services for the Army’s mobile communications network.

- $45 to support the engineering and manufacturing of the Navy’s Air and Missile Defense Radar (AMDR) program.

- $35 to build space encryption units for the Air Force.

- $25 from the Air Force for continued modernization of the global positioning system.

Marine Systems:

- $495 from the Navy for submarine industrial base development and expansion in support of the Columbia-class ballistic missile submarine program and the nuclear shipbuilding enterprise.

- $270 from the Navy to support the Common Missile Compartment work under joint development for the Navy and the U.K. Royal Navy..

- $85 from the Navy for planning yard, engineering and technical support services for in-service nuclear submarines.

- $55 from the Navy to provide ongoing lead yard services for the Arleigh Burke-class (DDG-51) guided-missile destroyer program..

|

|

Second Quarter

|

Six Months

|

||||||||||||||

|

|

2019

|

2018

|

2019

|

2018

|

||||||||||||

|

Gulfstream Aircraft Deliveries (units):

|

||||||||||||||||

|

Large-cabin aircraft

|

23

|

|

18

|

|

50

|

|

37

|

|

||||||||

|

Mid-cabin aircraft

|

8

|

|

8

|

|

15

|

|

15

|

|

||||||||

|

Total

|

31

|

|

26

|

|

65

|

|

52

|

|

||||||||

|

Pre-owned Aircraft Deliveries (units):

|

1

|

|

1

|

|

5

|

|

2

|

|

||||||||

|

Aerospace Book-to-Bill:

|

||||||||||||||||

|

Orders*

|

$

|

2,198

|

|

$

|

2,291

|

|

$

|

5,329

|

|

$

|

3,736

|

|

||||

|

Revenue (excluding pre-owned aircraft sales)

|

2,134

|

|

1,894

|

|

4,332

|

|

3,710

|

|

||||||||

|

Book-to-Bill Ratio

|

1.03x

|

|

1.21x

|

|

1.23x

|

|

1.01x

|

|

||||||||

|

*

|

Does not include customer defaults, liquidated damages, cancellations, foreign exchange fluctuations and other backlog adjustments.

|